How Industrial Self-driving Vehicles Use Sensors for Localization and Mapping

Girl power: All-female teams compete at robotics event

Tesla’s problem: overestimating automation, underestimating humans

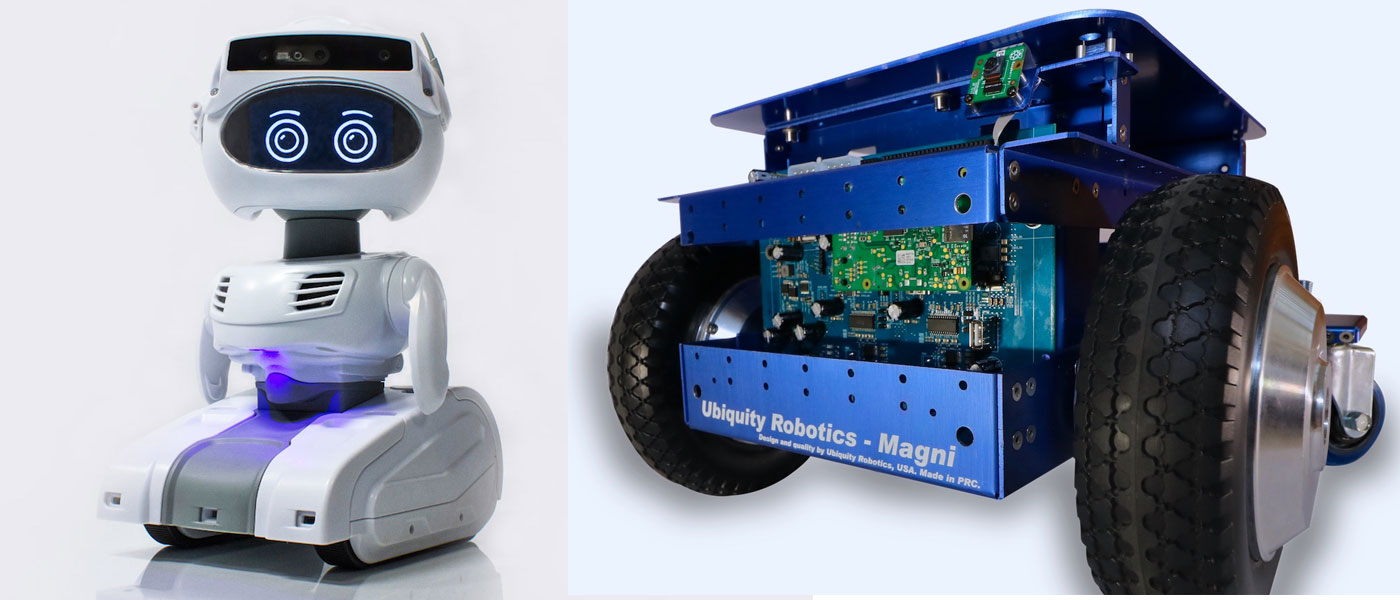

Magni and Misty – are these the droids we’ve been looking for?

Both are crowdfunding right now — Magni has only 1 week days to go and Misty has just launched today. Both robots come from pedigree robotics companies and both robots are top of the line in terms of capabilities. And I have to confess, I’m a sucker for great robot crowdfunding campaigns so have purchased one of each for Silicon Valley Robotics and Circuit Launch.

Both are crowdfunding right now — Magni has only 1 week days to go and Misty has just launched today. Both robots come from pedigree robotics companies and both robots are top of the line in terms of capabilities. And I have to confess, I’m a sucker for great robot crowdfunding campaigns so have purchased one of each for Silicon Valley Robotics and Circuit Launch.

Magni is a robust mobile platform capable of carrying a payload of over 100 kilos, developed by Ubiquity Robotics. It comes with all the sensors you need for autonomous navigation, indoor or outdoor, has a sophisticated power train, and runs on a Raspberry Pi and ROS. Magni is more than a hobbyist package, you can build commercial applications on the top of the base platform, for food or package delivery, mobile manipulation, kiosk robots or security, inventory…. etc.

Here’s what you get with Magni:

- Payload: 100 kg

- Drive System: 2 x 200 W hub motors, 2 m/s top speed

- Power: 7 A+ 5 V and 7 A+ 12 V DC power

- Computer: Quad-core ARM A9 — Raspberry Pi3

- Software: Ubuntu 16.04, ROS Kinetic

- Camera: Single upward facing

- Navigation: Ceiling fiducial based navigation

- Battery life: With 10 Ah batteries, 8 hours of normal operation. Up to 32 Ah lead acid batteries can be installed, which will provide 24 hours+ of normal operation

- 3D sensor (optional): 2x time of flight cameras, 120 degree field of view

In addition, Ubiquity is offering Loki, a small and more or less affordable learning platform that you can use to develop applications for Magni. The team at Ubiquity Robotics are well known in Silicon Valley as robotics experts and members of the Homebrew Robotics Club.

Misty Robotics also has a great pedigree, as the team is a spin off from Sphero by Orbotix. Sphero and sister/brother robot BB8 have been immensely popular, but cofounder Ian Bernstein felt that it was time to build a personal home robot with more capabilities than a toy. Misty Robotics was formed in 2017 but have kept their robot under wraps until this year — showcasing the first version of Misty 1 as a developer product in January and now releasing Misty 2 as a crowdfunding campaign.

From IEEE Spectrum: One of the things that should set Misty apart is that it’s been designed specifically to be able to perform advanced behaviors without requiring advanced knowledge of robotics. Out of the box, Misty II can:

- Move autonomously as well as dynamically respond to her environment

- Recognize faces

- Create a 3D map of her surroundings

- Perform seeing, hearing, and speaking capabilities

- Receive and respond to commands

- Locate her charger to charge herself

- Display emotive eyes and other emotional characteristics

All of this stuff can be accessed and leveraged if you know how to code, even a little bit. Or even not at all, since Misty can be programmed through Blockly. Misty is a great introduction to the realm of robotics!

Sadly what is also clear is that Misty Robotics has a far greater customer/support base than Ubiquity Robotics because both robots are worth purchasing (albeit for slightly different purchases) but the Ubiquity Robotics campaign hasn’t spread far beyond their Silicon Valley supporter base. I hope the campaign crosses the line because I want my robots!

Robotic fundings, acquisitions and IPOs: April 2018

Twenty startups were funded in April 2018.

Twenty startups were funded in April 2018.

Fifteen disclosed transaction amounts totaling $808 million of which the $600 million to SenseTime, the Alibaba-funded Chinese deep learning and facial recognition software provider focused on smart self-driving vehicle systems, was by far the largest.

Year to date, fundings total $2.3 billion!

Seven acquisitions also occurred in April. The most notable was the acquisition by Teradyne (which previously acquired Universal Robots and Energid) of MiR (Mobile Industrial Robots) for $148 million with an additional $124 million predicated on very achievable milestones between now and 2020.

Robotics Fundings

SenseTime, a Chinese deep learning and facial recognition software provider focused on smart self-driving vehicle systems, raised $600 million in a Series C funding round led by Alibaba Group with participation by Temasek Holdings and Suning Commerce Group.

Formlabs, a Somerville, Mass.-based manufacturer of industrial quality 3D printing systems, raised $30 million in a Series C funding. Tyche Partners led the round, and was joined by Shenzhen Capital Group, UpNorth Investment Limited, DFJ, Pitango and Foundry Group.

Zimplistic, a Singapore-based kitchen robotics firm which makes the $999 Rotimatic roti maker, raised $30 million in a Series C funding led by Credence Partners and EDBI.

6 River Systems, a Massachusetts-based point-to-point logistics mobile robot maker, raised $25 million in Series B funding in a round led by Menlo Ventures with participation from all existing investors (Norwest Venture Partners, Eclipse Ventures and iRobot). Details here.

Houston Mechatronics, a Texas defense and space systems integrator, raised $20 million in Series B funding from Iain Cooper and Simple-Fill. Funds will be used to develop a novel transformer-like underwater device called Aquanaut.

Houston Mechatronics, a Texas defense and space systems integrator, raised $20 million in Series B funding from Iain Cooper and Simple-Fill. Funds will be used to develop a novel transformer-like underwater device called Aquanaut.

Vicarious Surgical, a Cambridge, Mass-based robotic surgery startup, raised $16.75 million in Series A funding. Khosla Ventures and Innovation Endeavors led the round the round, and were joined by Gates Ventures, AME Cloud Ventures, and Marc Benioff.

Efy-Tech, a Chinese UAS control systems startup, raised $15.8 million in a Series A funding from Aviation Industry Corporation, a Chinese state-owned aerospace and defense company.

DeepScale, a Silicon Valley self-driving vehicle AI perception startup, raised $15 million in a Series A funding round led by Point72 and next47.

Ready Robotics, a Baltimore-based provider of collaborative robots as a service (RaaS), raised $15 million in funding. Drive Capital led the round, and was joined by Eniac Ventures and RRE Ventures.

Symbio Robotics, a Berkeley, CA robotics control software startup, raised $15 million from undisclosed sources.

Marble, a San Francisco-based developer of a fleet of intelligent courier robots, raised $10 million in Series A funding. Investors include Tencent, Lemnos, Crunchfund, and Maven.

Regulus Cyber, an Israeli startup developing and making security devices for drones and autonomous vehicles, raised $6.3 million in a Series A round led by Sierra Ventures and Canaan Partners Israel.

Comma.ai, the San Francisco startup led by superstar hacker George Hotz, raised $5 million in a Series A round although it’s unclear who invested in the round which was reported in an SEC filing.

Bear Robotics, a Silicon Valley mobile robot startup for the food industry, raised $3 million in a Seed round (in January) of which $2 million came from Korean food-tech firm Woowa Brothers.

Segway Robotics raised $1.1 million from 952 backers in an IndieGoGo campaign for their Loomo mobil robotic mini personal transporter which they are selling for $1,499 and begin shipping in May.

Robotics Fundings: amounts undisclosed

DroneSense, a Texas UAS platform for drone users and OEMs, raised an undisclosed amount from FLIR Systems. “This alliance with DroneSense will help bring to market a truly mission-critical solution needed by first responders to effectively deploy a complete UAS program across their organizations. We believe this platform is scalable geographically, across multiple markets, and across multiple FLIR Business Units,” said James Cannon, President and CEO of FLIR.

BBS Automation, a Germany-based global integrator of automated testing and inspection systems, raised an undisclosed amount from equity fund EQT Mid-Market which intends to assist BBS Automation’s growth ambitions both organically and through add-on acquisitions in new end markets.

Plug-and-play Panda robot

Franka Emika, a German startup producing the Panda co-bot, raised an undisclosed amount from their new joint venture partner, German conglomerate Voith. The new joint venture has launched Voith Robotics which will develop the Panda co-bot business while Franka will focus on the research and selling to academia and the research community.

Franklin Robotics, the Lowell MA startup that created a garden weeding robot named Tertill, sold 25% of the company to Husqvarna Group for an undisclosed amount. “With almost 1,500,000 environmentally friendly robotic mowers sold all over the world, Husqvarna Group has vast experience and insight that will be invaluable to us as we bring Tertill to market, and continue to develop robotic weeding solutions for the garden and beyond”, says Rory MacKean, CEO Franklin Robotics.

Intuition Robotics, an Israeli startup developing an eldercare social robot, raised an undisclosed amount (in January) from SamsungNEXT Ventures.

Acquisitions

UPDATE to the acquisition of Energid by Teradyne in February for an undisclosed amount. The amount is now known to be $25 million.

Beijing Aresbots Technology (Ares Robot), a Beijing startup developing Kiva-like warehousing robots, was acquired for an undisclosed amount by Face++, a Beijing facial recognition and ID company also known as Megvii.

Genesis Advanced Technology, the Canadian startup developing LiveDrive, a direct-drive actuator with torque-to-weight that can meet or beat motor-gearbox actuators, has been acquired by Koch Industries for an undisclosed amount. Koch will form a new company Genesis Robotics & Motion Technologies (Genesis Robotics) – to commercialize LiveDrive and related technologies. Details here.

Genmark Automation, a Fremont, CA maker of automation tools and wafer handling robots for the semiconductor industry, was acquired by Nidec Sankyo, a Japanese maker of motors, clean-room robots and robot components, for an undisclosed amount.

JR Automation, a Michigan industrial robot integrator, acquired Setpoint Systems, a Littleton, CO, an integrator of building automation solutions, and Setpoint, an Ogden, Utah amusement and theme parks ride designer. Financial terms weren’t disclosed.

MiR (Mobile Industrial Robots) , the Danish startup with 300% sales growth in 2017, was acquired by Teradyne (NYSE:TER) for $148 million with an additional $124 million predicated on very achievable milestones between now and 2020. Details here.

, the Danish startup with 300% sales growth in 2017, was acquired by Teradyne (NYSE:TER) for $148 million with an additional $124 million predicated on very achievable milestones between now and 2020. Details here.

Van Hoecke Automation, a Belgian-based industrial robot integrator, was acquired by Michigan-based Burke Porter Group for an undisclosed amount. BPG is a multi-subsidiary conglomerate providing testing and clean room equipment to the auto industry.

Wind River, a control systems software provider acquired by Intel, has been acquired by private equity firm TPG Capital for an undisclosed amount. “This acquisition will establish Wind River as a leading independent software provider uniquely positioned to advance digital transformation within critical infrastructure segments with our comprehensive edge to cloud portfolio,” said Jim Douglas, Wind River President. “At the same time, TPG will provide Wind River with the flexibility and financial resources to fuel our many growth opportunities as a standalone software company that enables the deployment of safe, secure, and reliable intelligent systems.”

IPOs

None

Failures

Revolve Robotics (developer of the KUBI tabletop remote presence device) has folded and turned over remaining sales, service and support to their Northern California manufacturer Xandex.

You may also like:

#259: AI and the Law, with Nicolas Economou

In this episode Andrew Vaziri speaks with Nicolas Economou, CEO of the eDiscovery company H5 and co-founder and chair of the Science, Law and Society Initiative at The Future Society, a 501c3 think tank incubated at the Harvard Kennedy School of Government. Economou discusses how AI is applied in the legal system, as well as some of the key points from the recent “Global Governance of AI Roundtable”. The roundtable, hosted by the government of the UAE, brought together a diverse group of leaders from tech companies, governments, and academia to discuss the societal implications of AI.

Nicolas Economou

Nicolas Economou is the chief executive of H5 and was a pioneer in advocating the application of scientific methods to electronic discovery. He contributes actively to advancing dialogue on public policy challenges at the intersection of law, science, and technology. He is co-chair of the Law Committee of the IEEE Global Initiative on Ethics of Autonomous and Intelligent Systems; is chair of The Future Society’s Science, Law and Society Initiative and Senior Advisor to its Artificial Intelligence Initiative; and chaired the Law Committee of the Global Governance of AI Roundtable hosted in Dubai as part of the 2018 World Government Summit.

Nicolas Economou is the chief executive of H5 and was a pioneer in advocating the application of scientific methods to electronic discovery. He contributes actively to advancing dialogue on public policy challenges at the intersection of law, science, and technology. He is co-chair of the Law Committee of the IEEE Global Initiative on Ethics of Autonomous and Intelligent Systems; is chair of The Future Society’s Science, Law and Society Initiative and Senior Advisor to its Artificial Intelligence Initiative; and chaired the Law Committee of the Global Governance of AI Roundtable hosted in Dubai as part of the 2018 World Government Summit.

Links

Power Density in Robotics

Amazon Announces Plans to Expand Boston Tech Hub and Create an Additional 2,000 Technology Jobs

Interview with a robot: AI revolution hits human resources

Tesla’s fetal crash

Tesla can do better than its current public response to the recent fatal crash involving one of its vehicles. I would like to see more introspection, credibility, and nuance.

Introspection

Over the last few weeks, Tesla has blamed the deceased driver and a damaged highway crash attenuator while lauding the performance of Autopilot, its SAE level 2 driver assistance system that appears to have directed a Model X into the attenuator. The company has also disavowed its own responsibility: “The fundamental premise of both moral and legal liability is a broken promise, and there was none here.”

In Tesla’s telling, the driver knew he should pay attention, he did not pay attention, and he died. End of story. The same logic would seem to apply if the driver had hit a pedestrian instead of a crash barrier. Or if an automaker had marketed an outrageously dangerous car accompanied by a warning that the car was, in fact, outrageously dangerous. In the 1980 comedy Airplane!, a television commentator dismisses the passengers on a distressed airliner: “They bought their tickets. They knew what they were getting into. I say let ‘em crash.” As a rule, it’s probably best not to evoke a character in a Leslie Nielsen movie.

It may well turn out that the driver in this crash was inattentive, just as the US National Transportation Safety Board (NTSB) concluded that the Tesla driver in an earlier fatal Florida crash was inattentive. But driver inattention is foreseeable (and foreseen), and “[j]ust because a driver does something stupid doesn’t mean they – or others who are truly blameless – should be condemned to an otherwise preventable death.” Indeed, Ralph Nader’s argument that vehicle crashes are foreseeable and could be survivable led Congress to establish the National Highway Traffic Safety Administration (NHTSA).

Airbags are a particularly relevant example. Airbags are unquestionably a beneficial safety technology. But early airbags were designed for average-size male drivers—a design choice that endangered children and lighter adults. When this risk was discovered, responsible companies did not insist that because an airbag is safer than no airbag, nothing more should be expected of them. Instead, they designed second-generation airbags that are safer for everyone.

Similarly, an introspective company—and, for that matter, an inquisitive jury—would ask whether and how Tesla’s crash could have been reasonably prevented. Tesla has appropriately noted that Autopilot is neither “perfect” nor “reliable,” and the company is correct that the promise of a level 2 system is merely that the system will work unless and until it does not. Furthermore, individual autonomy is an important societal interest, and driver responsibility is a critical element of road traffic safety. But it is because driver responsibility remains so important that Tesla should consider more effective ways of engaging and otherwise managing the imperfect human drivers on which the safe operation of its vehicles still depends.

Such an approach might include other ways of detecting driver engagement. NTSB has previously expressed its concern over using only steering wheel torque as a proxy for driver attention. And GM’s own level 2 system, Super Cruise, tracks driver head position.

Such an approach may also include more aggressive measures to deter distraction. Tesla could alert law enforcement when drivers are behaving dangerously. It could also distinguish safety features from convenience features—and then more stringently condition convenience on the concurrent attention of the driver. For example, active lane keeping (which might ping pong the vehicle between lane boundaries) could enhance safety even if active lane centering is not operative. Similarly, automatic deceleration could enhance safety even if automatic acceleration is inoperative.

NTSB’s ongoing investigation is an opportunity to credibly address these issues. Unfortunately, after publicly stating its own conclusions about the crash, Tesla is no longer formally participating in NTSB’s investigation. Tesla faults NTSB for this outcome: “It’s been clear in our conversations with the NTSB that they’re more concerned with press headlines than actually promoting safety.” That is not my impression of the people at NTSB. Regardless, Tesla’s argument might be more credible if it did not continue what seems to be the company’s pattern of blaming others.

Credibility

Tesla could also improve its credibility by appropriately qualifying and substantiating what it says. Unfortunately, Tesla’s claims about the relative safety of its vehicles still range from “lacking” to “ludicrous on their face.” (Here are some recent views.)

Tesla repeatedly emphasizes that “our first iteration of Autopilot was found by the U.S. government to reduce crash rates by as much as 40%.” NHTSA reached its conclusion after (somehow) analyzing Tesla’s data—data that both Tesla and NHTSA have kept from public view. Accordingly, I don’t know whether the underlying math actually took only five minutes, but I can attempt some crude reverse engineering to complement the thoughtful analyses already done by others.

Let’s start with NHTSA’s summary: The Office of Defects Investigation (ODI) “analyzed mileage and airbag deployment data supplied by Tesla for all MY 2014 through 2016 Model S and 2016 Model X vehicles equipped with the Autopilot Technology Package, either installed in the vehicle when sold or through an OTA update, to calculate crash rates by miles travelled prior to and after Autopilot installation. [An accompanying chart] shows the rates calculated by ODI for airbag deployment crashes in the subject Tesla vehicles before and after Autosteer installation. The data show that the Tesla vehicles crash rate dropped by almost 40 percent after Autosteer installation”—from 1.3 to 0.8 crashes per million miles.

This raises at least two questions. First, how do these rates compare to those for other vehicles? Second, what explains the asserted decline?

Comparing Tesla’s rates is especially difficult because of a qualification that NHTSA’s report mentions only once and that Tesla’s statements do not acknowledge at all. The rates calculated by NHTSA are for “airbag deployment crashes” only—a category that NHSTA does not generally track for nonfatal crashes.

NHTSA does estimate rates at which vehicles are involved in crashes. (For a fair comparison, I look at crashed vehicles rather than crashes.) With respect to crashes resulting in injury, 2015 rates were 0.88 crashes per million miles for light trucks and 1.26 for passenger cars. And with respect to property-damage only crashes, they were 2.35 for light trucks and 3.12 for passenger cars. This means that, depending on the correlation between airbag deployment and crash injury (and accounting for the increasing number and sophistication of airbags), Tesla’s rates could be better than, worse than, or comparable to these national estimates.

Airbag deployment is a complex topic, but the upshot is that, by design, airbags do not always inflate. An analysis by the Pennsylvania Department of Transportation suggests that airbags deploy in less than half of the airbag-equipped vehicles that are involved in reported crashes, which are generally crashes that cause physical injury or significant property damage. (The report’s shift from reportable crashes to reported crashes creates some uncertainty, but let’s assume that any crash that results in the deployment of an airbag is serious enough to be counted.)

Data from the same analysis show about two reported crashed vehicles per million miles traveled. Assuming a deployment rate of 50 percent suggests that a vehicle deploys an airbag in a crash about once every million miles that it travels, which is roughly comparable to Tesla’s post-Autopilot rate.

Indeed, at least two groups with access to empirical data—the Highway Loss Data Institute and AAA – The Auto Club Group—have concluded that Tesla vehicles do not have a low claim rate (in addition to having a high average cost per claim), which suggests that these vehicles do not have a low crash rate either.

Tesla offers fatality rates as another point of comparison: “In the US, there is one automotive fatality every 86 million miles across all vehicles from all manufacturers. For Tesla, there is one fatality, including known pedestrian fatalities, every 320 million miles in vehicles equipped with Autopilot hardware. If you are driving a Tesla equipped with Autopilot hardware, you are 3.7 times less likely to be involved in a fatal accident.”

In 2016, there was one fatality for every 85 million vehicle miles traveled—close to the number cited by Tesla. For that same year, NHTSA’s FARS database shows 14 fatalities across 13 crashes involving Tesla vehicles. (Ten of these vehicles were model year 2015 or later; I don’t know whether Autopilot was equipped at the time of the crash.) By the end of 2016, Tesla vehicles had logged about 3.5 billion miles worldwide. If we accordingly assume that Tesla vehicles traveled 2 billion miles in the United States in 2016 (less than one tenth of one percent of US VMT), we can estimate one fatality for every 150 million miles traveled.

It is not surprising if Tesla’s vehicles are less likely to be involved in a fatal crash than the US vehicle fleet in its entirety. That fleet, after all, has an average age of more than a decade. It includes vehicles without electronic stability control, vehicles with bald tires, vehicles without airbags, and motorcycles. Differences between crashes involving a Tesla vehicle and crashes involving no Tesla vehicles could therefore have nothing to do with Autopilot.

More surprising is the statement that Tesla vehicles equipped with Autopilot are much safer than Tesla vehicles without Autopilot. At the outset, we don’t know how often Autopilot was actually engaged (rather than merely equipped), we don’t know the period of comparison (even though crash and injury rates fluctuate over the calendar year), and we don’t even know whether this conclusion is statistically significant. Nonetheless, on the assumption that the unreleased data support this conclusion, let’s consider three potential explanations:

First, perhaps Autopilot is incredibly safe. If we assume (again, because we just don’t know otherwise) that Autopilot is actually engaged for half of the miles traveled by vehicles on which it is installed, then a 40 percent reduction in airbag deployments per million miles really means an 80 percent reduction in airbag deployments while Autopilot is engaged. Pennsylvania data show that about 20 percent of vehicles in reported crashes are struck in the rear, and if we further assume that Autopilot would rarely prevent another vehicle from rear-ending a Tesla, then Autopilot would essentially need to prevent every other kind of crash while engaged in order to achieve such a result.

Second, perhaps Tesla’s vehicles had a significant performance issue that the company corrected in an over-the-air update at or around the same time that it introduced Autopilot. I doubt this—but the data released are as consistent with this conclusion as with a more favorable one.

Third, perhaps Tesla introduced or upgraded other safety features in one of these OTA updates. Indeed, Tesla added automatic emergency braking and blind spot warning about half a year before releasing Autopilot, and Autopilot itself includes side collision avoidance. Because these features may function even when Autopilot is not engaged and might not induce inattention to the same extent as Autopilot, they should be distinguished from rather than conflated with Autopilot. I can see an argument that more people will be willing to pay for convenience plus safety than for just safety alone, but I have not seen Tesla make this more nuanced argument.

Nuance

In general, Tesla should embrace more nuance. Currently, the company’s explicit and implicit messages regarding this fatal crash have tended toward the absolute. The driver was at fault—and therefore Tesla was not. Autopilot improves safety—and therefore criticism is unwarranted. The company needs to be able to communicate with the public about Autopilot—and therefore it should share specific and, in Tesla’s view, exculpatory information about the crash that NTSB is investigating.

Tesla understands nuance. Indeed, in its statement regarding its relationship with NTSB, the company noted that “we will continue to provide technical assistance to the NTSB.” Tesla should embrace a systems approach to road traffic safety and acknowledge the role that the company can play in addressing distraction. It should emphasize the limitations of Autopilot as vigorously as it highlights the potential of automation. And it should cooperate with NTSB while showing that it “believe[s] in transparency” by releasing data that do not pertain specifically to this crash but that do support the company’s broader safety claims.

For good measure, Tesla should also release a voluntary safety self-assessment. (Waymo and General Motors have.) Autopilot is not an automated driving system, but that is where Tesla hopes to go. And by communicating with introspection, credibility, and nuance, the company can help make sure the public is on board.

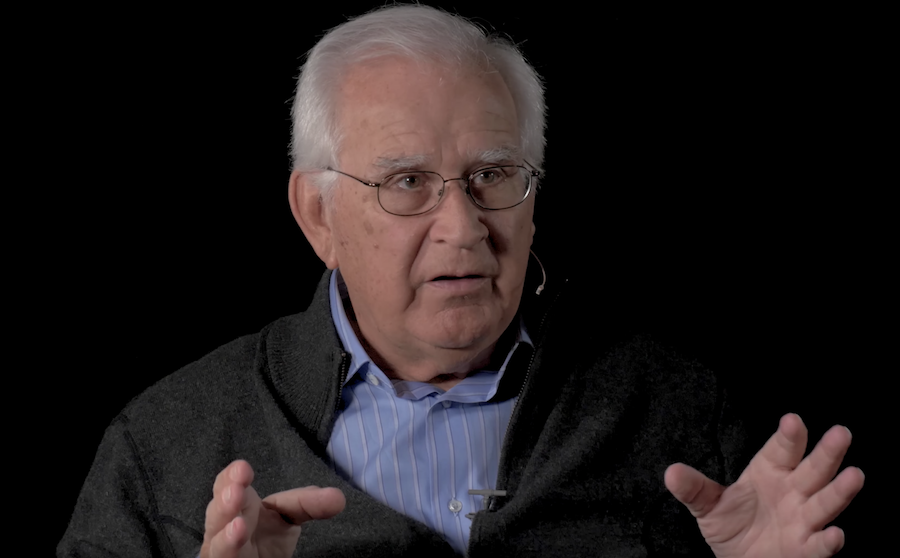

Robots in Depth with Frank Tobe

In this episode of Robots in Depth, Per Sjöborg speaks with Frank Tobe about his experience covering robotics in The Robot Report and creating the index Robo-Stox.

In this episode of Robots in Depth, Per Sjöborg speaks with Frank Tobe about his experience covering robotics in The Robot Report and creating the index Robo-Stox.

Frank talks about how and why he shifted to robotics and how looking for an investment opportunity in robotics lead him to start Robo-Stox (since renamed to ROBO Global), a robotics focused index company.

Both companies have given Frank a unique perspective on the robotics scene as a whole, over a significant period of time.

Teradyne acquires MiR for $272M, continues robotics spree

In a surprise but smart move, Teradyne (NYSE:TER), the American test solutions provider that acquired Universal Robots in 2015 and Energid Technologies earlier in 2018, acquired Danish MiR (Mobile Industrial Robots) for $148 million with an additional $124 million predicated on very achievable milestones between now and 2020.

In a surprise but smart move, Teradyne (NYSE:TER), the American test solutions provider that acquired Universal Robots in 2015 and Energid Technologies earlier in 2018, acquired Danish MiR (Mobile Industrial Robots) for $148 million with an additional $124 million predicated on very achievable milestones between now and 2020.

MiR was just returning from celebrating its 300% growth in 2017 at a company get-together in Barcelona with 70 MiR employees from all over the world when the announcement was made. It tripled its revenue from autonomous mobile robots (AMRs) in 2017. MiR co-founder and CEO Thomas Visti said that growth in 2017 was primarily due to multinational companies that returned with orders for larger fleets of mobile robots after it tested and analyzed the results of its initial MiR robot orders.

Another factor in MiR’s 2017 growth was the launch of the MiR200 which can lift 440 pounds, pull 1,100 pounds, is ESD approved and cleanroom certified. “The MiR200 has been very well received and represents a large part of our sales. The product meets clear needs in the market and increases potential applications for autonomous mobile robots. Combined with our new and extremely user-friendly interface – which even employees without programming experience can use – it makes it even simpler for our customers to implement and use our robots,” Visti said.

Another factor in MiR’s 2017 growth was the launch of the MiR200 which can lift 440 pounds, pull 1,100 pounds, is ESD approved and cleanroom certified. “The MiR200 has been very well received and represents a large part of our sales. The product meets clear needs in the market and increases potential applications for autonomous mobile robots. Combined with our new and extremely user-friendly interface – which even employees without programming experience can use – it makes it even simpler for our customers to implement and use our robots,” Visti said.

Another reason for MiRs rapid growth has been its initial strategic decision to develop and market solely to a growing network of integrator/distributors originally developed by Visti when he was VP of Sales at Universal Robots. MiR presently has 132 distributors in 40 countries with regional offices in New York, San Diego, Singapore, Dortmund, Barcelona and Shanghai – and the lists are growing.

Teradyne, by this acquisition, is hoping to capitalize on the synergies between MiR and UR as shown in the chart above. Both offer end users fast ROI and low cost of entry and provide Teradyne with attractive gross margins and rapid growth.

“We are excited to have MiR join Teradyne’s widening portfolio of advanced, intelligent, automation products,” said Mark Jagiela, President and CEO of Teradyne. “MiR is the market leader in the nascent, but fast growing market for collaborative autonomous mobile robots (AMRs). Like Universal Robots’ collaborative robots, MiR collaborative AMRs lower the barrier for both large and small enterprises to incrementally automate their operations without the need for specialty staff or a re-layout of their existing workflow. This, combined with a fast return on investment, opens a vast new automation market. Following the path proven with Universal Robots, we expect to leverage Teradyne’s global capabilities to expand MiR’s reach.”

Earlier this year, Teradyne acquired Energid for $25 million in a talent and intellectual property acquisition. Energid, which is exhibiting and speaking at the Robotics Summit & Showcase, developed the robot control and tasking framework Actin which is used in industrial, commercial, collaborative, medical and space-based robotic systems and is a UR partner. Teradyne sees Actin as an enabling technology for advanced motion control and collision avoidance.

MiR founder and CSO Niels Jul Jacobsen, Visti, and investors Esben Østergaard, Torben Frigaard Rasmussen, and Søren Michael Juul Jørgensen should all be proud of their achievement thus far. Congratulations to all!