Participants and startups in the emerging self-driving vehicles industry (components, systems, trucks, cars and buses) have been at it for over almost 60 years. The pace accelerated in 2004, 2005 and 2007 when DARPA sponsored long-distance competitions for driverless cars, and then again in 2009 when Uber began its ride-hailing system.

As the prospects that self-driving ride-hailing fleets, vehicles, systems and associated AI would soon be a reality, startups, fundings, mergers and acquisitions have followed reaching a peak in 2017. Thus far in 2017 more than 55 companies and startups offering everything from solid state distancing sensors to ride-share fleets and mapping systems – plus five strategic acquisitions – raised over $28.2 billion!

2017 Investments Trends: Self-driving

Listed below are month-by-month recaps of self-driving-related fundings and acquisitions as reported by The Robot Report. The two massive fundings by the SoftBank Vision Fund in May, the Intel acquisition of Movidius in March and Ford’s acquisition of Argo in February are extraordinary. Nevertheless, pulling out those billion dollar transactions still shows that $2.4 billion found its way to more than 55 companies. [The trend continues in November with Optimus Ride and Ceres Imaging both raising Series A money.]

Click on the month for funding details, links and profiles for each of the companies.

- October – $957.24 million:

- Mapbox-$164M, Element AI-$105M, Horizon Robotics-$100M, Innoviz Technologies-$8, Momenta AI-$46, Built Robotics-$15, Blickfeld-$4.25, nuTonomy was acquired by Delphi Automotive-$450M, and Strobe was acquired by General Motors-unknown amount.

- September – $275 million:

- LeddarTech-$101M, Innoviz Technologies-$65M, JingChi-$52M, Five AI-$35M, Drive AI-$15M, Ushr Inc-$10M and Metawave-$7M.

- August – $70 million:

- Oryx Vision-$50M and TuSimple-$20M.

- July – $413 million:

- Nauto-$159M, Brain Corp-$114M, Momenta AI-$46, Autotalk-$40M, Slamtec-$22M, Embark-$15M, Xometry-$15M and Metamoto-$2M.

- June – $112.5 million:

- Drive AI-$50M, Swift Navigation-$34M, AEye-$16M, Carmera-$6.4M, Cognata-$5 and Optimus Ride-$1.1.

- May – $9.676 billion:

- Didi Chuxing-$5.5 billion, Nvidia-$4 billion, ClearMotion-$100M, Echodyne-$29M, DeepMap-$15M, Hesai Photonics Technology-$16M, TriLumina-$9M, AIRY 3D-$3.5M and Vivacity Labs-$3.3M.

- April – $306.6 million:

- Mobvoi-$180M, Peloton Technology-$60M, Luminar Technology-$36M, Renovo Auto-$10M, Aurora Innovation-$6.1M, VIST Group-$6M, DeepScale-$3M, Arbe Robotics-$2.5M, BestMile-$2M, Compound Eye-$1M.

- March – $15.343 billion:

- Wayray-$18M, EasyMile-$15M, SB Drive-$4.6M, Starsky Robotics-$3.75M and CrowdAI-$2M. Intel acquired Mobileye for $15.3 billion.

- February – $1.024 billion:

- ZongMu Technology-$14.5M andTetraVue-$10M. Ford Motor Co acquired Argo AI-$1 billion.

- January – $??? million:

- Autonomos was acquired by TomTom-unknown amount.

The SoftBank Vision Fund Effect

Plentiful money and sky high valuations are causing more companies to delay IPOs. The SoftBank Vision Fund is a key enabler of this recent phenomena. Founded in 2017 with a goal of $100 billion (they closed with $93 billion) with principle investors including SoftBank, Saudi Arabia’s sovereign wealth fund, Abu Dhabi’s national wealth fund, Apple, Foxconn, Qualcomm and Sharp, the Fund has been disbursing at a rapid pace. According to recode, the Fund, through August, had invested over $30 billion in Uber, ARM, Nvidia, WeWork, OneWeb, Flipkart, OSIsoft, Roivant, SoFi, Fanatics, Improbable, OYO, Slack, Plenty, Nauto and Brain Corp. Many on that list are involved in the self-driving industry.

Plentiful money and sky high valuations are causing more companies to delay IPOs. The SoftBank Vision Fund is a key enabler of this recent phenomena. Founded in 2017 with a goal of $100 billion (they closed with $93 billion) with principle investors including SoftBank, Saudi Arabia’s sovereign wealth fund, Abu Dhabi’s national wealth fund, Apple, Foxconn, Qualcomm and Sharp, the Fund has been disbursing at a rapid pace. According to recode, the Fund, through August, had invested over $30 billion in Uber, ARM, Nvidia, WeWork, OneWeb, Flipkart, OSIsoft, Roivant, SoFi, Fanatics, Improbable, OYO, Slack, Plenty, Nauto and Brain Corp. Many on that list are involved in the self-driving industry.

The NY Times, in an article describing Masayoshi Son’s grand plan for the Fund, wrote that all these companies “have something in common: They are involved in collecting enormous amounts of data, which are crucial to creating the brains for the machines that, in the future, will do more of our jobs and creating tools that allow people to better coexist.”

Further, Son said he believed robots would inexorably change the work force and machines would become more intelligent than people, an event referred to as the “Singularity.” Mr. Son [said he] is on a mission to own pieces of all the companies that may underpin the global shifts brought on by artificial intelligence to transportation, food, work, medicine and finance. His vision is not just about predictions like the Singularity. He understands that we’ll need a massive amount of data to get us to a future that’s more dependent on machines and robotics.

Bottom Line

Companies involved in the emerging self-driving industry accounted for most of the dollars invested thus far in 2017. SoftBank’s fund and Masayoshi Son’s grand plan, combined with auto companies grabbing talent through strategic acquisitions, partnerships and investments, are leading the way. Robotics-related agricultural and healthcare-related investments were a distant second and third. Fourth went to underwater drones, systems and components.

Twenty-eight different startups were funded in October cumulatively raising $862 million, up from $507 million in September. Three of the top four fundings were for startups involved in the self-driving process. An additional five lower-amount startups were also funded for self-driving applications or components along with two of the six acquisitions.

Twenty-eight different startups were funded in October cumulatively raising $862 million, up from $507 million in September. Three of the top four fundings were for startups involved in the self-driving process. An additional five lower-amount startups were also funded for self-driving applications or components along with two of the six acquisitions.

SharkNinja is a fast-growing vendor of blenders, vacuums and other household products. They displaced Dyson in vacuums by engineering a superior product at a value price point (the Dyson robot vacuum sold for $1,000). SharkNinja, by using disruptive pricing and infomercial marketing, has garnered around 20% of the U.S. market for vacuums in just 10 years. SharkNinja’s non-robotic vacuums and blenders command significant shelf space and are very popular with customers and sellers alike. Thus they are a formidable competitor.

SharkNinja is a fast-growing vendor of blenders, vacuums and other household products. They displaced Dyson in vacuums by engineering a superior product at a value price point (the Dyson robot vacuum sold for $1,000). SharkNinja, by using disruptive pricing and infomercial marketing, has garnered around 20% of the U.S. market for vacuums in just 10 years. SharkNinja’s non-robotic vacuums and blenders command significant shelf space and are very popular with customers and sellers alike. Thus they are a formidable competitor. iRobot has been making defensive moves recently. It acquired its two main distributors: Robopolis in Europe and Sales on Demand in Japan. It has used up much of its cash reserve to buy back shares of the company. And it sued what it considered to be patent violations by Hoover, Black & Decker, Bobsweep, Bissell Homecare, and Micro-Star International (MSI) (which manufacturers the Hoover and Black & Decker vacuums).

iRobot has been making defensive moves recently. It acquired its two main distributors: Robopolis in Europe and Sales on Demand in Japan. It has used up much of its cash reserve to buy back shares of the company. And it sued what it considered to be patent violations by Hoover, Black & Decker, Bobsweep, Bissell Homecare, and Micro-Star International (MSI) (which manufacturers the Hoover and Black & Decker vacuums).

In an OpEd piece in the NY Times, and in a TED Talk late last year, Oren Etzioni, PhD, author, and CEO of the Allen Institute for Artificial Intelligence, suggested an update for Isaac Asimov’s three laws of Artificial Intelligence. Given the widespread media attention emanating from Elon Musk’s (and others) warnings, these updates might be worth reviewing.

In an OpEd piece in the NY Times, and in a TED Talk late last year, Oren Etzioni, PhD, author, and CEO of the Allen Institute for Artificial Intelligence, suggested an update for Isaac Asimov’s three laws of Artificial Intelligence. Given the widespread media attention emanating from Elon Musk’s (and others) warnings, these updates might be worth reviewing. In an

In an  Etzioni has updated those three rules in his

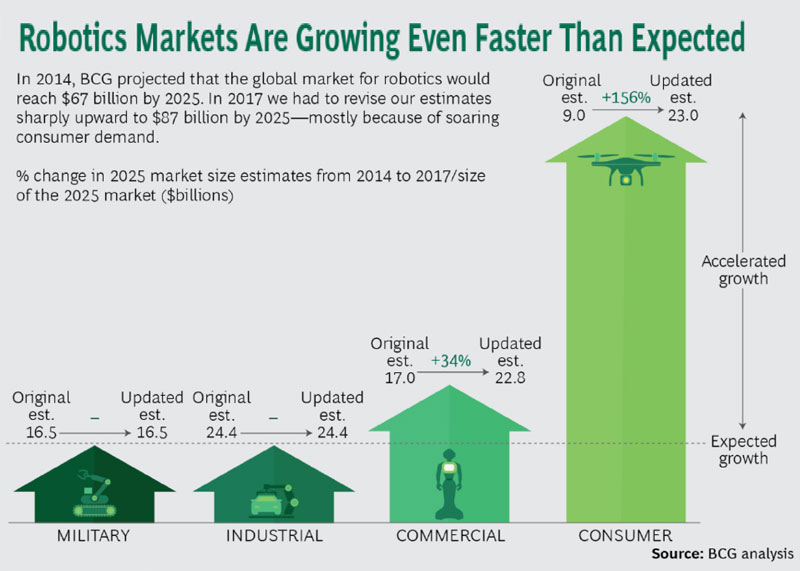

Etzioni has updated those three rules in his  China has recently announced their long-term goal to become #1 in A.I. by 2030. They plan to grow their A.I. industry to over $22 billion by 2020, $59 billion by 2025 and $150 billion by 2030. They did this same type of long-term strategic planning for robotics – to make it an in-country industry and to transform the country from a low-cost labor source to a high-tech manufacturing resource… and it’s working.

China has recently announced their long-term goal to become #1 in A.I. by 2030. They plan to grow their A.I. industry to over $22 billion by 2020, $59 billion by 2025 and $150 billion by 2030. They did this same type of long-term strategic planning for robotics – to make it an in-country industry and to transform the country from a low-cost labor source to a high-tech manufacturing resource… and it’s working.