TL;DR

JointFM is the first AI foundation model for zero-shot joint distributional forecasting in multivariate time-series systems. By generating coherent future scenarios in milliseconds, it enables real-time portfolio decision-making without the lag of traditional numerical simulations. JointFM represents a paradigm shift in quantitative modeling: trained on an infinite stream of dynamics from synthetic stochastic differential equations (SDEs), JointFM acts as your digital quant.

Setting the stage: why quantitative modeling needs a new approach

Modeling complex systems has traditionally required a painful trade-off. Classical quant methods (like correlation copulas or coupled SDEs) offer high mathematical fidelity but are rigid, slow, and expensive. They often require specialized teams to rebuild models whenever the market regime or asset mix changes. Conversely, existing time-series foundation models offer speed and flexibility but are single-target, missing the critical cross-variable dependencies that define systemic risk.

JointFM is your “digital quant“ to bridge this gap. Trained on an infinite stream of synthetic stochastic differential equations (SDEs), it learns the universal physics of time-series dynamics, making it truly domain-agnostic. Whether for a power grid or a stock portfolio, it predicts the full joint probability distribution of the system in milliseconds. This is the foundation of instant decision-making in highly complex setups and is fast enough to integrate with agents for ad-hoc business decisions.

In this project, we demonstrate its power in quantitative finance, building on NVIDIA’s quantitative portfolio optimization blueprint. JointFM enables instant portfolio optimization (IPO), replacing brittle overnight batch processes with a digital quant that can rebalance portfolios in real time and adapt to new assets or market conditions without retraining.

Key takeaways

- The first zero-shot foundation model for joint distributions: JointFM predicts full multivariate distributions out of the box, capturing correlations and tail risk.

- Instant simulation at portfolio scale: thousands of coherent future scenarios are generated in milliseconds, independent of portfolio complexity, enabling real-time decision-making and AI agent integration.

- Matches the risk-adjusted returns of the classical benchmark: across 200 controlled synthetic trials, JointFM achieved equal risk-adjusted performance.

- Pre-trained on synthetic stochastic processes: by learning from millions of generated dynamics, JointFM generalizes to new assets and market conditions without retraining.

- From financial modeling to financial AI: JointFM replaces classical pipelines with a scalable, domain-agnostic foundation model.

The core challenge: speed, fidelity, and flexibility

In quantitative finance, portfolio managers have long faced a customized trilemma:

- Fast but flawed: models like Geometric Brownian Motion (GBM) are computationally cheap but assume normal distributions and constant correlations. They fail spectacularly during market crashes, when assets become highly correlated and fat tails appear.

- Accurate but slow: heavy Monte Carlo simulations with complex copulas or regime-switching variations capture reality better but take much longer to calibrate and run, making them impractical when you need to rebalance your portfolio on short notice.

- Rigid and expensive: developing high-fidelity models requires specialized quantitative modeling teams, significant time, and money. Worse, these models are often brittle; when the market regime shifts or you want to swap asset classes, you often need to start modeling again from scratch.

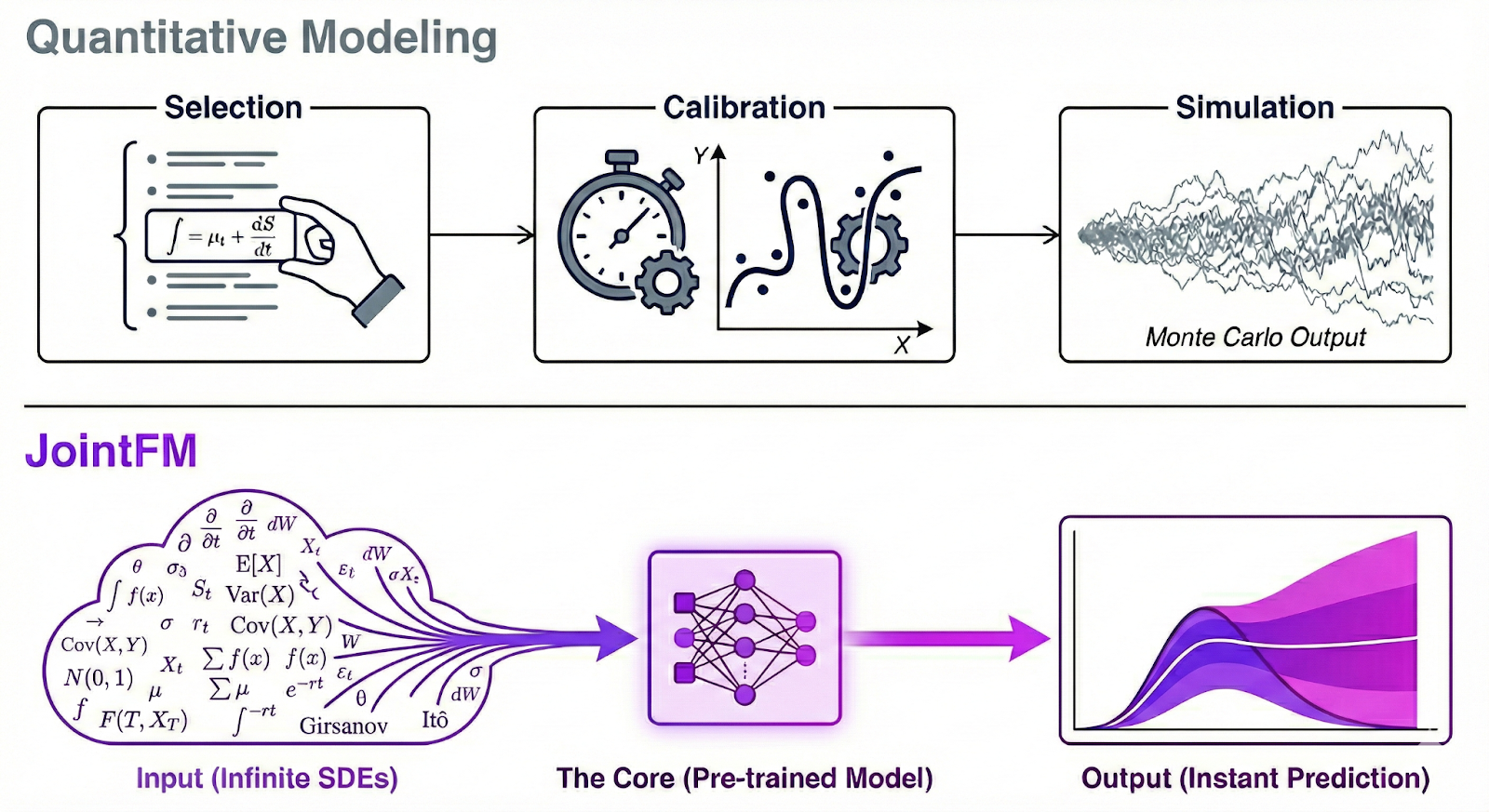

Enter JointFM: a foundation model for joint distributions

JointFM changes the game by “skipping” the modeling step. Instead of fitting parameters for each time series daily, JointFM is a pre-trained model that generalizes to unseen data out of the box. While we apply it here to financial markets, the model itself is domain-agnostic. It learns the language of stochastic processes, not just stock tickers.

The innovation

Until now, modeling joint distributions required significant compromises. You could define complex systems of SDEs (mathematically difficult), fit specialized classical models to specific datasets (slow and requiring retraining), or use copulas (bespoke and rigid).

None of these are zero-shot.

On the other hand, existing foundation models are zero-shot but fail to capture cross-variable dependencies. JointFM is the first to bridge this divide, offering the scale and zero-shot speed of a foundation model with the mathematical depth of a rigorous joint probability framework.

This zero-shot capability solves the rigidity problem. Facing a new market situation where you don’t know the underlying dynamics? Want to swap difficult-to-model assets instantly? JointFM works just the same. Because it has learned to predict future joint distributions from almost any dynamic during its diverse pre-training, it serves as the best possible starting point for unknown environments without the need for a dedicated quant team to build a new model from scratch.

Key capabilities

- Joint distributional forecasting: unlike standard univariate time-series models that predict marginal probabilities for one variable at a time, JointFM explicitly models the full multivariate distribution of all variables simultaneously. In finance, this is critical for diversification. You cannot optimize a portfolio without understanding how assets move together.

- Zero-shot inference: no training required on the user’s data. The model has already “seen it all” during pre-training.

- Scenario slicing: the model can condition predictions on exogenous variables (e.g., “Show me the distribution of variables if an external factor rises”).

If you want to read more about time-series and tabular foundation models, have a look at this article on the brewing GenAI data science revolution, which gives an introduction to the field and explains why a model like JointFM is the next logical step.

Under the hood: architecture & speed

JointFM leverages a specialized transformer-based architecture designed to handle the unique high-dimensional constraints of multivariate time series.

1. Efficient high-dimensional context

To model portfolios with many assets over long history windows, JointFM moves beyond the quadratic complexity of standard attention mechanisms. Like other single-target models, JointFM employs a factored attention strategy that efficiently decouples temporal dynamics from cross-variable dependencies. This allows the model to scale linearly with the complexity of the portfolio, processing hundreds of assets without becoming a computational bottleneck.

2. Heavy-tailed distributional heads

Real-world data is rarely normal; it often exhibits heavy tails and skewness. JointFM utilizes a flexible output layer capable of parameterizing robust, fat-tailed multivariate distributions. This enables the model to naturally capture the probability of extreme events (“black swans”) that are critical for accurate risk assessment.

3. Parallel decoding for instant results

Speed is the central enabler of instant portfolio optimization. While also supporting an autoregressive mode, the model architecture is optimized for parallel decoding, allowing it to predict all future horizons simultaneously in a single forward pass. This capability—distinct from the slow, sequential generation of traditional autoregressive models—enables the generation of thousands of coherent market scenarios in milliseconds on a GPU.

The secret sauce: synthetic pre-training

Why does JointFM work so well on real data without seeing it? Synthetic pre-training.

Real historical data is often finite, noisy, and regime-specific. To build a truly general foundation model, JointFM is trained on an infinite curriculum of synthetic data generated by a flexible engine. We lead with finance because of its notoriously complex dynamics and its significance as a benchmark application for our work. However, while the domain is specialized, the core technology is universal.

- SDESampler: this is the core of the system. It generates complex stochastic differential equations (SDEs) with jumps, complex drifts, path-dependent memory, and regimes. It is designed to simulate any continuous-time system with stochastic components.

- FinanceSampler: to address the wide array of financial asset classes, we developed a specialized sampler that works alongside our generic engine. For the purpose of this simple benchmark comparison, we limited the selection to the most fundamental asset classes: equities, precious metals, and foreign exchange (FX).

- Custom extensibility: while we focused on finance, the same architecture allows us to build other samplers (e.g., for weather, energy, or sensor data) to target different domains.

This approach exposes the model to millions of regimes, ensuring it learns the fundamental physics of time-series dynamics rather than just memorizing historical patterns.

Performance evaluation: benchmarking against classical methods

We compared JointFM-optimized portfolios against classical Geometric Brownian Motion (GBM)-optimized portfolios as a simple baseline. Read about our experiment setup below, followed by the results.

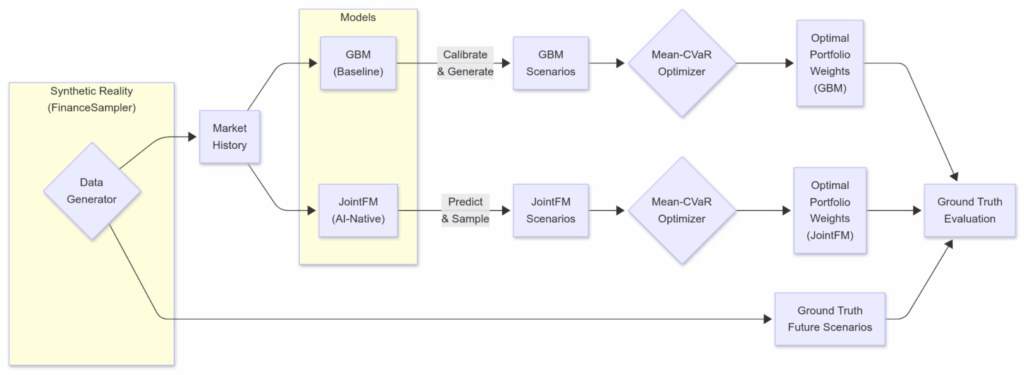

Experimental setup

Our portfolio optimization setup, while drawing inspiration from the NVIDIA blueprint, incorporates a few key differences. Similar to the blueprint, we utilize the same GBM simulation and Mean-CVaR optimization but use JointFM as an alternative scenario generator and our FinanceSampler as well as S&P 500 stock prices as input data.

- Input:

- Synthetic reality: We generate complex asset histories using the FinanceSampler (SDEs with stochastic volatility, correlated drifts, etc.). This ensures we have a ground-truth multiverse of future possibilities for objective evaluation.

- Real data (secondary check): we also plug in real historical returns (S&P 500) to confirm the model generalizes to the noisy, imperfect real world.

- Inference:

- GBM—classical SDE calibration and path generation from the NVIDIA blueprint.

- JointFM—trained on similar but not identical synthetic physics—generates 10,000+ plausible future return scenarios in milliseconds. It effectively acts as a “future oracle” that intimately understands the statistical laws governing the assets.

- Risk optimization:

- A Mean-CVaR (conditional value at risk) optimizer solves for the portfolio weights that maximize risk-adjusted returns (balancing expected return against tail risk).

- A Mean-CVaR (conditional value at risk) optimizer solves for the portfolio weights that maximize risk-adjusted returns (balancing expected return against tail risk).

- Execution and scoring:

- We deploy the optimal weights into the known future:

- Synthetic ground-truth data provides thousands of scenarios for evaluation per experiment step.

- Real data has one known future for every historical experiment.

- We deploy the optimal weights into the known future:

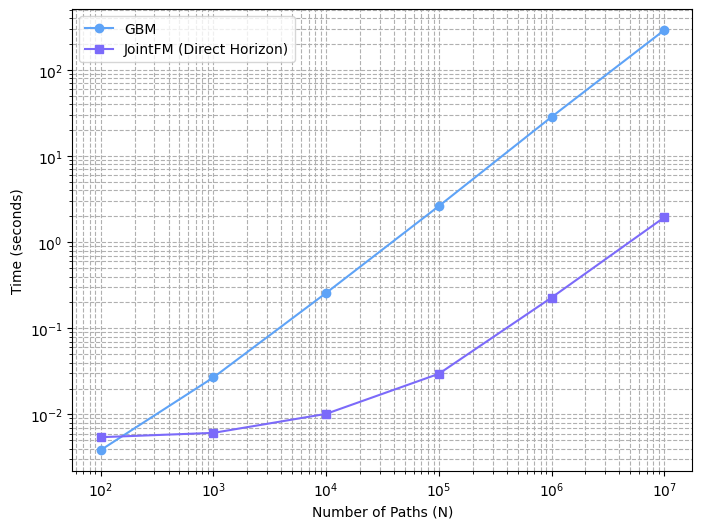

Speed: simulate the future instantly

JointFM generates scenarios in milliseconds, even orders of magnitude faster than relatively simple geometric Brownian motion (GBM) simulations.

This architectural advantage enables timely reactions to market changes and makes it practical to integrate sophisticated simulation and portfolio optimization directly into an AI agent. As a result, investors can explore and discuss investment decisions in real time without additional operational overhead.

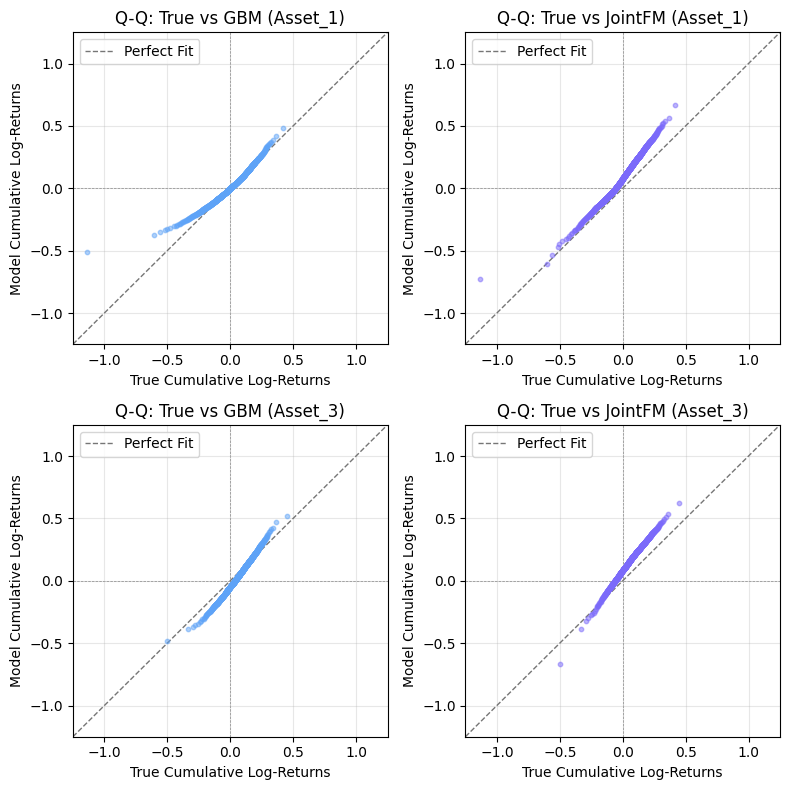

Performance on marginals: looking at one asset at a time

JointFM recovers the marginal distributions of complex assets to some extent. Below we show the Q-Q (quantile-quantile) plot for each percentile and two random assets of one anecdotal simulation/prediction.

While we clearly aim to further improve the marginal predictability, there are two things here that are critical to understand:

- The dynamics of financial assets are notoriously hard to predict (here 63 days ahead).

- Being good at making marginal predictions alone does not help with risk management very much. It is critical to capture asset correlations as well.

Directly comparing high-dimensional joint probability distributions is impractical. Instead, we present a simple demonstration showing that JointFM provides consistent and reliable predictions for portfolio optimization, matching or exceeding the baseline quantitative method.

Portfolio evaluation (synthetic ground truth)

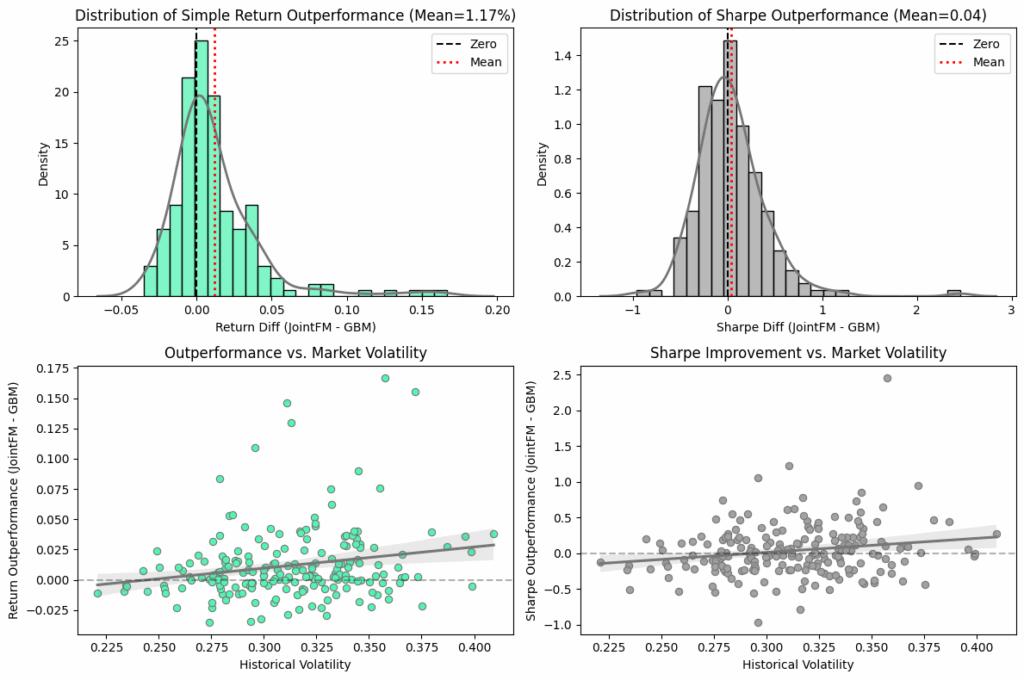

To rigorously evaluate performance, we conducted 200 repeated portfolio optimization trials using synthetic data in which the true future joint distributions are known. This controlled setting allows us to directly compare JointFM-generated portfolios and our baseline against the ground-truth optimum.

The results

- Simple returns: JointFM portfolios achieved 1.17% higher returns on average.

- Risk-adjusted returns: the Sharpe ratio is practically the same. JointFM shows a slightly better risk-adjusted return.

On the synthetic oracle data, the JointFM portfolio has a 1.17% higher return on average but at a roughly identical risk-adjusted return (Sharpe ratio), which means that the outperformance resulted from more risk-taking. Given its roughly identical performance in terms of risk-adjusted return, which is the more important metric, our first version of JointFM emerges as a fast, cheap, flexible, and simple drop-in alternative to the baseline approach.

Real-world sanity check

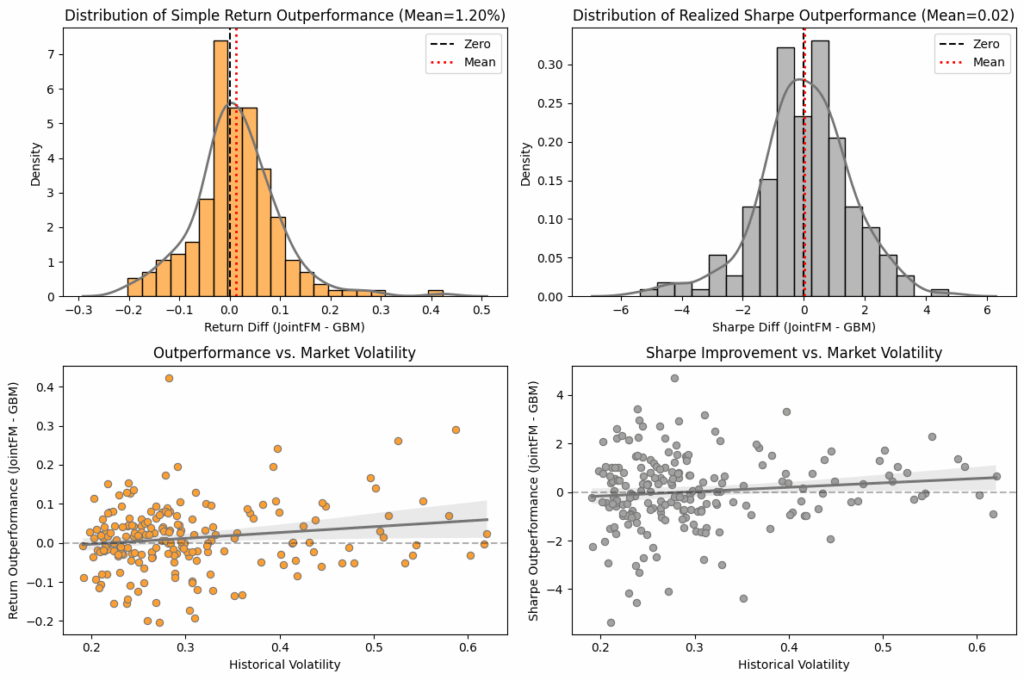

Addressing the potential concern that our model is only good at solving the specific synthetic problems it was trained on, we validated the approach on real S&P 500 data (Yahoo Finance). We randomly sampled 10 assets over 200 different time periods out of a universe of 391 different stocks from the S&P 500.

The results

JointFM-portfolios, similar to their performance on the synthetic test datasets, showed a higher simple return. Their risk-adjusted return is approximately the same as the comparison, slightly outperforming it. This confirms that the model has learned generalizable rules of volatility and correlation, not just memorized a specific set of data-generating processes.

Wrapping up: instant portfolio optimization

By replacing rigid statistical assumptions with a flexible, pre-trained foundation model, JointFM enables a new class of trading and risk management agents. These agents don’t just react to price changes; they instantly re-simulate the future multiverse to find the best path forward. JointFM significantly accelerates inference by front-loading the extensive scientific modeling into the training stage. This allows for near-instantaneous inference execution.

This represents a shift from financial modeling (fitting equations) to financial AI (using foundation models), offering both the speed required for modern markets and the depth required for survival.

Should you have any questions, please contact us at research@datarobot.com.

The post The digital quant: instant portfolio optimization with JointFM appeared first on DataRobot.