7 Best Mobile Banking Apps In The USA

Mobile banking apps provide customers with 24/7 access to view their account balances and past transactions. Due to the flexibility in accessing and convenience of using mobile banking apps, they are grabbing user attention across the world. Unlike traditional bank deposits by standing in a long queue, digital banking apps are helping users to send or receive money instantly through their mobile devices.

Brand finance companies worldwide are going digital to seize market opportunities and provide more personalized banking services to their customers. In this article, we would like to discuss a list of mobile banking apps in USA. These leading banking apps in the U.S. have higher downloads and usage percentages.

Best Mobile Banking Apps in USA 2025: What’s Going?

Mobile banking apps are the fastest-growing app category in the United States. Almost 90% of banks in the USA are going digital to provide fast and contactless banking services to customers in this pandemic situation. It has become a driver for the increasing adoption and usage of mobile banking apps in the USA.

Due to COVID-19, installations and usage of banking and finance apps have been flourishing since 2019. According to market research reports, downloads and registrations of digital banking applications in the United States increased by nearly 60% during the past year. Here are the significant reasons behind the growth in banking apps downloads in the country.

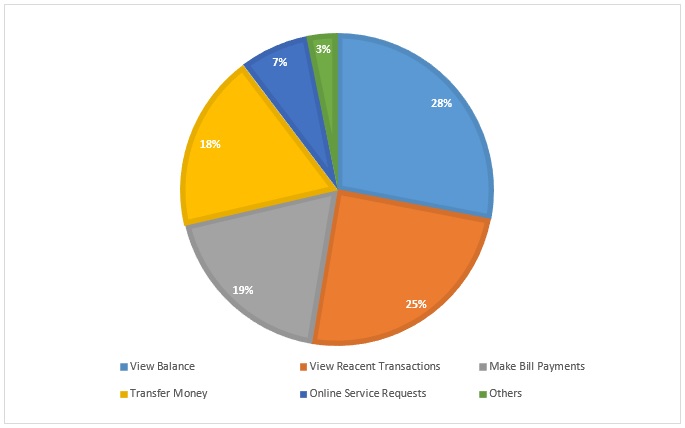

As depicted in the pie chart, the most common reason to install and use a mobile banking app in the United States in 2020 was to check account balances. Approximately 90% of smartphone users are downloading banking applications to check their account balances on the go.

Followed the convenience of banking apps to view transaction history, remit money, and credit bill payments, the other significant reasons for a surprising hike in app installations in the USA.

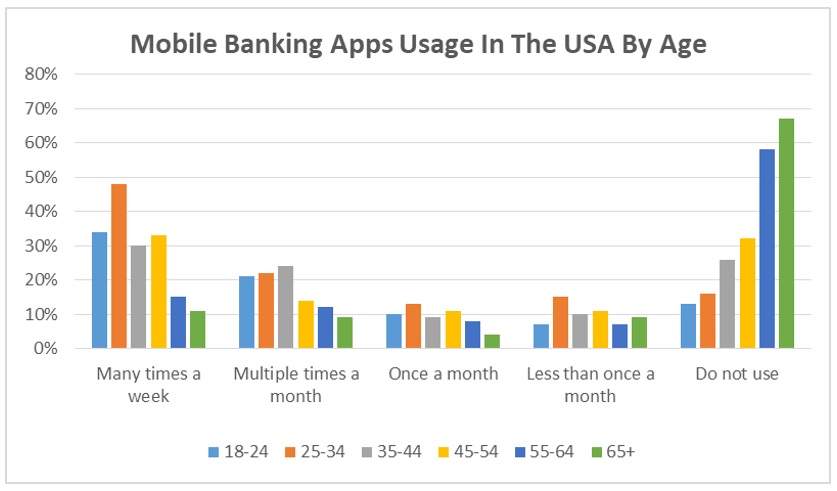

A noteworthy point is that the demand for Android or iPhone banking apps in the USA is from people between 25 to 44 years of age. The below figure depicts the growth of mobile banking applications in the USA from younger generations and millennials.

Recommend To Read: Top 10 Use Cases Of AI In The Banking Sector

So, these usage trends are ensuring a profitable and appreciable way for banking app development in the USA during the coronavirus pandemic. In the context of the COVID-19 pandemic, the development of virtual or digital banking apps for Android and iOS in the USA, like those in COVID-impacted countries, will allow people to manage their finances through mobiles without visiting a physical bank branch for their needs.

If you are looking ahead to mobile app development services in the USA, get the best price from us. Contact Now!

Here is the top list of mobile banking apps in the USA, and you can confidently create a clone of any one of the below-listed mobile applications to catch up with the digital market opportunities in the country.

The Most Popular Mobile Banking Apps In The United States

If you would like to know more about the best mobile banking apps in USA 2025, we are here to help you out. Below you can find the list of best mobile banking apps for iPhone as well as the best mobile banking apps in USA for Android. Let us take a look at the best 7 out of the top 10 banking apps in USA:

#1. Chime-Most downloaded banking app in the USA

Chime is the best banking app in the USA. It has over 10 million user downloads from app stores yet. Driven by user-friendly features like Touch ID, face ID, a two-way authentication process, fee-free overdraft up to $200, early paycheck clearance, zero maintenance fees, and instant transaction alerts, this app is listed as the most trusted banking application in the USA. The app is compatible with both Android and iPhone banking apps.

#2. Bank Of America Mobile Banking- Most used banking app in the USA

The Bank of America mobile banking app is one of the best mobile banking apps in USA for Android and iOS. This top banking application in the USA has a 4.6+ app rating and 10,000,000+ installs. This digital banking app allows users to deposit cheques, view credit scores, set up custom transaction alerts, e-bill payments, set up travel notifications, and overall organize accounts and loans digitally. It is also popular with its guaranteed cashback offers with BankAmeriDeals®.

#3. Acorns- Highly downloaded banking apps in the United States

It has acquired the top position in the list of mobile banking apps in USA. Acorns is an American leading banking and also a top FinTech services app. The significant advantages of Acorns-like popular mobile banking applications are easy to check personal and investment account details, the flexibility of direct deposit and mobile check deposit, transaction tracking and history viewing facilities, and high-level authentication processes for fraud detection and prevention.

#4. Current- A famous mobile banking app in the United States

Current is an on-demand mobile banking application in the USA. This leading banking apps in the U.S is available for both Android and iOS users. The benefits of Current-like banking app development in the USA is fee-free overdrafts up to $100, cheque deposits using a mobile camera, insights into money sending, support for Google Pay, Touch ID and Face ID security controls, and many more. Further, the app also allows users to get notifications on bill payments, instant money transfers, and content related to budget management strategies.

#5. Varo Bank- Popular banking app with a high usage rate

It is a popular iPhone banking apps for customers in the USA. Varo is a famous mobile banking app in the United States of America (USA) that runs seamlessly on Android and iPhone/iOS mobile devices. The app was popularized in responding to user queries 24/7. The users of the Varo Bank app will also get a virtual visa® debit card instantly that gives the users access to 55,000+ fee-free Allpoint® ATMs in stores like Target, CVS, and Walgreens.

This innovative mobile banking application also facilitates the users to send money across Varo and external bank accounts, get transaction alerts, and track spending on the go.

Recommend to Read: Power Of AI & ML Technologies In Banking & Finance

#6. USAA-The Best Android/iOS App for Banking, Finance, and Investment

The USAA Mobile banking app gives convenient and secure access to bank accounts from mobile devices. With its secure features and robust functionalities, it has secured a position in the list of the top 10 banking apps in USA. This app helps users manage banking, finances, investments, and insurance accounts in an encrypted manner.

Send money with Zelle (USA-based digital payments network), pay bills, make mobile cheque deposits, check loan eligibility, calculate EMI, and access e-wallets are a few of the best advantages of USAA-like popular banking apps in the USA. Currently, the app has a 4.8 out of 5 star rating and over 5 million downloads.

#7. Ally Mobile- Trending banking app in the USA for banking and investments

Ally is a leading banking and finance app available for Windows, iOS, and Android. The app was developed by Ally Financial Company, headquartered in Detroit, Michigan, USA. To provide 24/7 support to customers, the company launched Ally Mobile App in 2012.

The core features and functionalities of these trending banking applications are Ally eCheck Deposit, Check account balances and transaction history, instant money transfer, view/download account statements, Zelle® for paying US bank accounts, Ally Messenger for chatting, Ally Invest to invest in US stocks and ETFs with zero commission fees. This app also helps users to find the nearest ATMs by enabling mobile GPS.

How much does it cost to develop an on-demand android banking app like Ally Mobile Banking?

If you are looking ahead to banking app development and planning to launch it in the USA, here are the best features that must be added to a mobile banking application.

What Features Will Give Success To Your New Banking App?

The above list of mobile banking apps in the USA is popularized with the features they offer their customers. Mobile app design, features, and functionalities decide the success rate of the application. The cost to create a mobile banking app also highly depends on the features you have added. Being one of the best Banking and FinTech mobile apps development companies in the USA, we have compiled a list of the must-have features in banking apps to ensure their success in the app stores.

- Easy registration & login: Give flexibility to the users to access the app functionality using their mobile number or email address.

- Account/profile management to allow users to edit profiles as per their needs.

- Provide high security for the user’s confidential data.

- Real-time data analytics and reports to give a clear representation of account information in charts and help them in analyze their account performance

- Instant money remittance feature to send/receive money securely across internal and external banking accounts through secured payment gateways.

- Instant payments anywhere at anytime.

- Pay bills feature to pay credit bills.

- Push notifications & updates feature to send alerts to the users about transactions and investments.

- Give access to customer service by enabling the in-app chatbot feature.

- Flexibility to add multiple bank accounts

- Secure password and fingerprint authentication ways

- Transactional and promotional alerts

- Locating the nearest branches and ATMs

- Enable QR code payments for fast and secure mobile payments.

- Integrate a spending tracker for provide valuable insights into the accounts.

- Integrate your banking app with popular e-payment or mobile wallet payment apps like Google Pay and PayPal.

How Much Does It Cost To Build Mobile Banking Apps?

Estimating the cost to create a mobile banking app is quite difficult. Mostly, the cost of developing a banking app will be around $40,000 to $250,000. However, this estimated development cost will depend on app features, app platform, app type, app design, and User Interface (UI) complexity. Further, the hourly rate of mobile app developers in the USA will differ from the mobile app development companies located in India.

Besides, the estimated cost of the banking application development (android or iOS) will also depend on the mobile app development team size and the overall time taken by the mobile Application Development Company that you hire.

Would you like to know the actual Mobile Banking App Development Cost? Get in Touch to get a free quote on Banking App Cost Estimate!

Do you have any banking app development ideas?

Let’s talk to USM Business Systems– the best mobile banking apps development company in the USA. We develop custom mobile applications for the banking and finance industry. We help you with estimated banking app development cost so that you can align them with your budget.

We use cutting-edge Artificial Intelligence (AI) and Machine Learning (ML) capabilities to create next-generation digital banking and financial solutions that increase customer retention rates, prevent fraudulent acts, and reduce overall operating costs for banks.

Get in touch to know more about USM’s mobile banking development services!

[contact-form-7]