Uber, the global ride-sharing transportation company, has named two replacements to recover from the recent firing of Anthony Levandowski who headed their Advanced Technologies Group, their OTTO trucking unit, and their self-driving team. Levandowski was fired May 30th.

Eric Meyhofer

Meyhofer, who before coming to Uber was the co-founder of Carnegie Robotics and a CMU robotics professor, was also part of the group that came to Uber from CMU (see below). He has now been named to head Uber’s Advanced Technologies Group (ATG) self-driving group and will report directly to Uber CEO Travis Kalanick.

The ATG group is charged with developing the self-driving technologies of mapping, perception, safety, data collection and learning, and self-driving for cars and trucks.

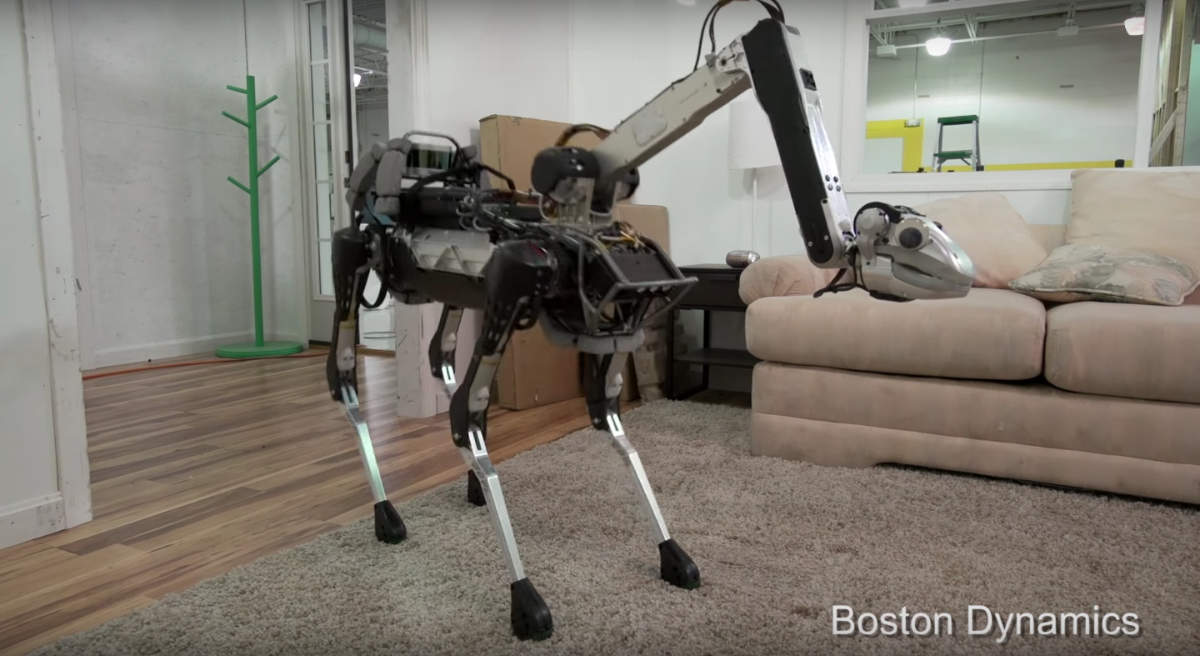

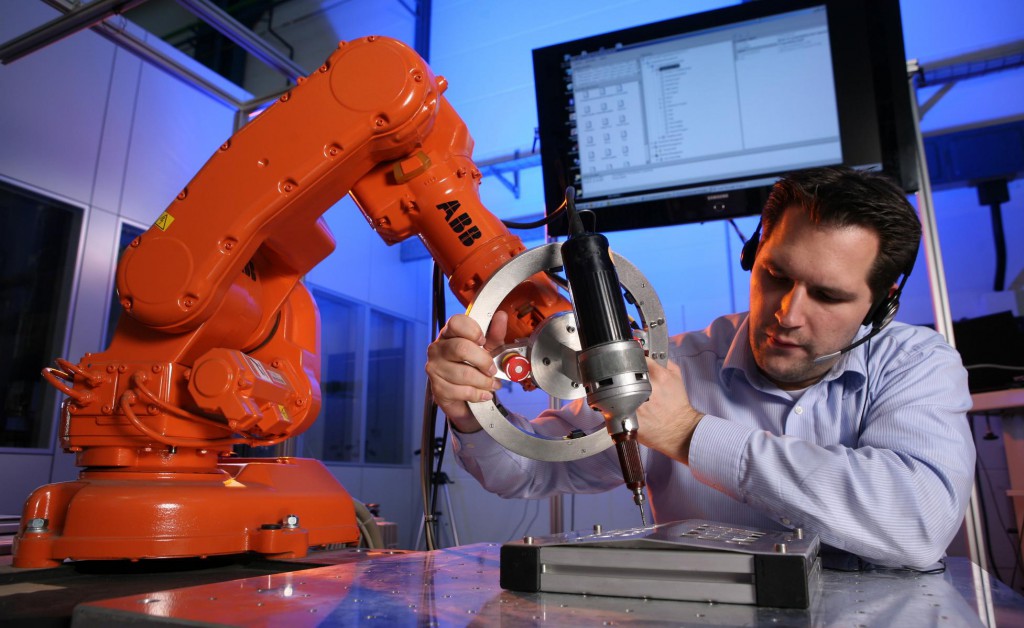

Sensors that determine distances are integral to the process. Elon Musk said recently that LiDAR isn’t needed because cameras, sensors, software and high-speed GPUs can do the same tricks at a fraction of the cost. Levandowski favored LiDARs, particularly newly developed solid state LiDAR technologies.

Anthony Levandowski

Levandowski, the previous head of the ATG, joined Google to work with Sebastian Thrun on Google Street View, started a mobile mapping company that experimented with LiDAR technology and another to build a self-driving LiDAR-using car (a Prius). Google acquired both companies including their IP. In 2016 Levandowski left Google to found Otto, a company making self-driving kits to retrofit semi-trailer trucks. Just as the kit was launched, Uber acquired Otto and Levandowski became the head of Uber’s driverless car operation in addition to continuing his work at Otto.

The Levandowski case, which caused Uber to fire him, revolves around the intellectual property and particularly the LiDAR-related technologies that Google’s and Uber’s self-driving plans revolve around. Getting the cost of perception down to a reasonable level has been part of the bigger challenge of self-driving technology and LiDAR technology is integral to that plan.

Google’s Waymo self-driving unit is implying in their suit that in return for bringing Google’s IP to Uber, Uber gave Levandowski $250 million in stock grants. Uber has called Waymo’s claims baseless and an attempt to slow down a competitor.

Waymo also claims that Uber has a history of “stealing” technology and includes the time in 2015 when Uber hired away 50+ of the Carnegie Mellon University robotics team – a move that cost Uber a reported $5 billion and created havoc at CMU and the National Robotics Engineering Centre (NREC) which lost 1/3 of their staff to Uber. The move was preceded by establishing a strategic partnership with CMU to work together on self-driving technologies. Four months later, Uber hired the 50.

The Daily Mail headlines said:

Carnegie Mellon left decimated after Uber poaches 40 top-rated robotic researchers to help them develop self-driving cars

- Carnegie Mellon ‘in crisis’ after mass defection of scientists to Uber

- Uber hope their fleet of taxis will not require drivers in the future

- Used $5 billion from investors to poach at least 40 from the National Robotics Engineering Center

- Uber took six principal investigators and 34 engineers

Brian Zajac

Zajac has been on Uber’s self-driving team since 2015 after stints with Shell and the U.S. Army. Now he becomes the new chief of hardware development and reports to Meyhofer.

David Morris, writing for Fortune, wrote:

“Zajac will now bear a great deal of responsibility for cracking the driverless car problem, which Uber CEO Travis Kalanick has described as “existential” to the company. Uber loses huge amounts of money, and many observers think eliminating the cost of drivers is its only realistic path to profitability.”

Bottom line:

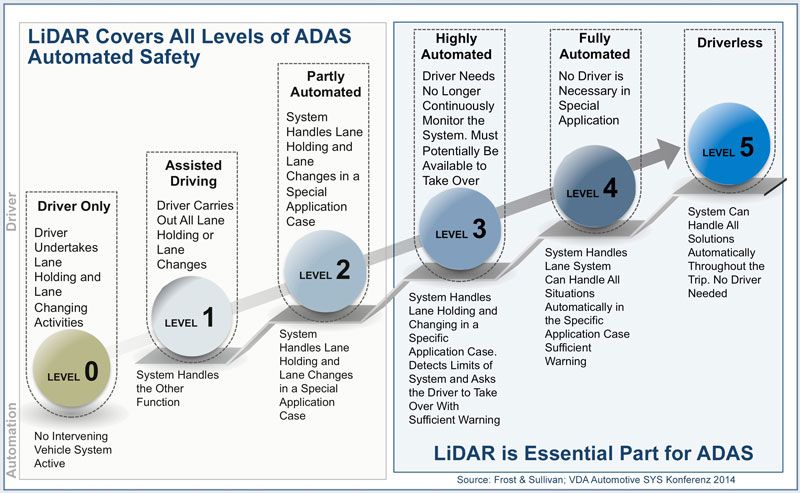

Uber has research teams in Silicon Valley, Toronto and Pittsburgh all working to perfect Level 5 autonomous driving capabilities before any of their competitors are able to duplicate the process. Google, Baidu, Yandex, Didi Chuxing, a few of the Tier 1 component makers, and many others including all the major car companies are racing forward with the same intentions. Levandowski’s firing caused a big gap in Uber’s self-driving project management and fear amongst their investors. Uber hopes that these two changes, Meyhofer as overall head and Zajac as hardware chief, will quell the fears that Uber is losing their momentum.