Peak Season is the Lie Detector for Warehouse Robotics

ChatGPT Now Clocking 900 Million Weekly Users

It’s official: 900 million people are now flocking to ChatGPT each week for AI-powered writing, answers, thinking and more.

Most of those people use the free version of ChatGPT, while about 50 million users access the AI via a paid subscription, according to writer Aisha Malik.

Adds Malik: “The new weekly active user figure marks a jump of 100 million users from the 800 million that OpenAI reported in October 2025.”

In other news and analysis in AI writing:

*Meet Your Even Tougher Workplace Competitor: ChatGPT-5.4: OpenAI says its newest AI engine – GPT-5.4 — matches or outperforms many human professionals 83% of the time, according to the maker.

The new model is also more accurate and is 18% less likely to generate errors and 33% less likely to come back with false claims, according to OpenAI.

GPT-5.4 is currently rolling out as ChatGPT-5.4 and is also available via direct computer API access.

*U.S. Military, Government Pivots Away from Anthropic Products: Angry that AI titan Anthropic refused to share full access to its tools for any legal purpose, President Donald Trump has banned use of Anthropic products by the U.S. government.

Observes lead writer Kali Hays: “The company had grown concerned in recent months about the government potentially using its AI tools — like Claude — in what it described as mass surveillance and fully autonomous weapons.”

Claude and similar Anthropic tools are currently the number one choice among many computer coders.

*Hyperlocal Newsletter Firm — Powered by AI — Has a Million Subscribers: Newsletter maker Patch has come up with a new way to hyper-personalize newsletters with AI – even if only one person subscribes.

Observes writer Liz Skalka: “Give the site your zip code and it would produce a daily or twice-weekly newsletter customized for your town, for a minimum readership of one subscriber.

“The newsletters rely heavily on aggregation, automated event calendars and posts from Nextdoor (a hyperlocal social media network).”

*Grammarly Offering ‘Expert Reviews’ of Your Writing – Without Permission From Those Experts: AI proofreading tool Grammarly is now offering free reviews of your writing by prominent virtual academics, authors and similar experts – both living and dead – using AI.

Problem is, none of those experts granted Grammarly permission to use their thinking for such a purpose – which has more than a few people ticked.

Observes writer Miles Klee: “Instead of producing what looks like a generic critique from a nameless LLM, it lists a number of real academics and authors available to weigh in on your text. To be clear: Those people have nothing to do with this process.”

*The More You Chat, The More Errors You Get: New research finds that the more questions you ask in a specific chat, the more likely you’ll encounter errors and hallucinations.

Bottom line: Expect chatbots like ChatGPT-5.0 and newer to lose up to 33% accuracy if you engage in multi-message chats.

Even worse: Expect older AI engines to lose up to 39% accuracy.

*Another AI Tool Promises to Auto-Generate Press Releases: Add ‘Free AI Press Release Generator’ to the growing cadre of tools promising to create press releases for you with AI.

Unlike many AI writing tools, this one focuses entirely on press release writing and follows standard press release form and function developed by journalists.

*AI Agents May Soon Face Special Microsoft Fee: Microsoft is currently mulling adding a special fee for AI agents that use Microsoft products.

Observes writer Richard Speed: “The megacorp is considering a new Microsoft 365 subscription tier, informally dubbed E7, that would bundle Copilot and agent management tools.”

The reasoning: “As AI agents function as digital workers, they need identities, email accounts, Teams access, and policy controls – capabilities currently tied to user subscriptions,” Speed adds.

*Microsoft ‘Copilot Tasks:’ Redmond Takes Another Shot at AI Agents: Microsoft has rolled out a slightly different AI agent for consumer users of Copilot, designed to take a more active role in getting tasks done.

Observes writer Laurent Giret: “Microsoft described the feature as a To-Do list that does itself, done by an AI agent using its own computer and web browser in the background.”

Potential uses include creation of draft email replies each morning, general AI writing, online shopping, event planning, and more.

*Facebook Parent Meta Out With New AI Shopping Assistant: CEO Mark Zuckerberg’s empire has expanded a bit with a new, experimental AI shopping assistant.

Observes writer Mariella Moon: “At the moment, it’s reportedly only showing up on desktop browsers when select users visit Meta AI on the Web.”

Users prompting the assistant for shopping tips get back a virtual carousel of product images and pricing — as well as a link to where they can buy the product.

The AI is also able to customize suggestions based on gender and location if you share that personal data with Meta.

Share a Link: Please consider sharing a link to https://RobotWritersAI.com from your blog, social media post, publication or emails. More links leading to RobotWritersAI.com helps everyone interested in AI-generated writing.

–Joe Dysart is editor of RobotWritersAI.com and a tech journalist with 20+ years experience. His work has appeared in 150+ publications, including The New York Times and the Financial Times of London.

The post ChatGPT Now Clocking 900 Million Weekly Users appeared first on Robot Writers AI.

New ultra-low-cost technique could slash the price of soft robotics

AWD and SWD drive solutions for AMRs

Robot Talk Episode 147 – Miniature living robots, with Maria Guix

Claire chatted to Maria Guix from the University of Barcelona about combining electronics and biology to create biohybrid robots with emergent properties.

Maria Guix is a chemist and nanotechnology researcher in the University of Barcelona’s ChemInFlow lab, developing miniaturised living robots and integrating flexible sensors into microfluidic platforms to better understand biohybrid robotic platforms. Her PhD research at the Autonomous University of Barcelona focussed on nanomaterials for biosensing. She has held postdoctoral positions at IFW Dresden, Purdue University, and the Institute for Bioengineering of Catalonia, advancing biocompatible micromotors, magnetic microrobot automation, and functional living robots.

Broadcom Inc. (AVGO) — AI Equity Research Update | March 2026

This analysis was produced by an AI financial research system. All data is sourced exclusively from publicly available filings, earnings transcripts, government data, and free financial aggregators — no proprietary data, paid research, or institutional tools are used. Every figure cited can be independently verified by the reader using the sources listed at the end...

The post Broadcom Inc. (AVGO) — AI Equity Research Update | March 2026 appeared first on 1redDrop.

Researchers are combining drones and AI to make removing land mines faster and safer

Graphene-based ‘artificial skin’ brings human-like touch closer to robots

Reachy 2: The Open-Source Humanoid Robot Redefining Human-Machine Interaction

Humanoid robots master parkour and acquire human-like agility

Developing an optical tactile sensor for tracking head motion during radiotherapy: an interview with Bhoomika Gandhi

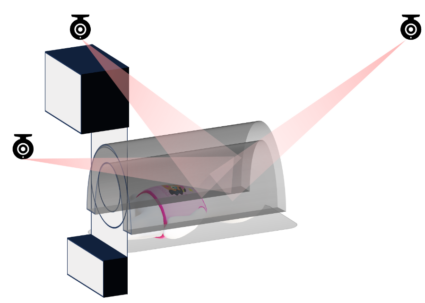

Illustration of the radiotherapy room and the occlusion problem faced by ceiling-mounted cameras in this application.

Illustration of the radiotherapy room and the occlusion problem faced by ceiling-mounted cameras in this application.

What was the topic of your PhD research and why was it an interesting area?

My topic of research was developing an optical tactile sensor to track head motion during radiotherapy. I worked on both the hardware and software development of this sensor, though my focus was mostly on the software side. Its importance comes from the fact that during radiotherapy, patients undergoing head and neck cancer treatment are typically immobilised. This is usually done using a thermoplastic mask, which can feel very claustrophobic, or a stereotactic frame. Frames are more common for brain cancers, but they have to be surgically inserted into the patient’s skull using pins. Either of these immobilisation tools may be used depending on the situation. When patients are uncomfortable, they are more likely to move, which affects the accuracy of treatment, especially with thermoplastic masks.

Another major issue is that current systems use ceiling-mounted cameras to record patient motion. These cameras cannot be placed too close to the patient because of the electromagnetic environment around the equipment. Their view is also frequently occluded because the patient moves into a tunnel to receive the ionising beams, which makes it difficult to capture rotational motion.

One alternative is an infrared camera with a nose marker, but this only captures translational motion. Currently, when a nose tracker detects movement beyond a certain threshold, treatment is paused, the patient is repositioned, and treatment resumes. It is difficult to adapt this system to reliably measure the rotational motion of the patient’s head in the radiotherapy environment.

This is where the Motion Capture Pillow (MCP) comes in, which contains the optical tactile sensor I developed. The goal with this system is similar to the nose tracker, but with more accurate rotational feedback for the radiographer. It can be placed beneath the patient’s head and attached to the treatment bed. It estimates how much the patient’s neck is rotating and improves patient comfort. Radiographers can receive real-time feedback on both translational and rotational movement. The advantages of this system are that there are no occlusions, because the pillow is in direct contact with the patient’s head, and it is more compatible with radiotherapy environments because the sensor is non-ferromagnetic. Its premise is to maintain patient comfort, stay compact and easy to integrate into the pre-existing systems for radiotherapy, whilst improving the accuracy of the treatment through real-time head tracking.

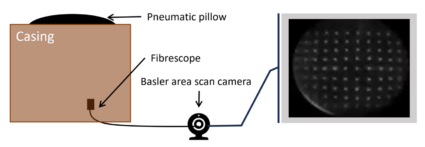

Labelled diagram of the Motion Capture Pillow – Optical tactile sensor for head tracking during radiotherapy. The pneumatic pillow is a deformable rubber-like sheet with embedded white markers, held in its convex shape using air pressure. The fibrescope represents a non-ferromagnetic fibre optic bundle used as a lens extension to an area scan camera. The camera is ferromagnetic and will require safe positioning and fixation.

Labelled diagram of the Motion Capture Pillow – Optical tactile sensor for head tracking during radiotherapy. The pneumatic pillow is a deformable rubber-like sheet with embedded white markers, held in its convex shape using air pressure. The fibrescope represents a non-ferromagnetic fibre optic bundle used as a lens extension to an area scan camera. The camera is ferromagnetic and will require safe positioning and fixation.

What were the main contributions of your work?

There were four main contributions to my work. The first contribution focused on making the system more non-ferromagnetic and improving the imaging and tracking approach. Previous work used a webcam and binary image processing within the optical tactile sensor to track marker displacement. I ultimately decided to use a fibrescope, optical flow tracking algorithm, and grayscale imaging instead, which improved the sensor’s tracking ability.

The second contribution focused on optimising marker density. The optical tactile sensor consists of an array of markers on a deformable rubber-like sheet, resembling a pillow. The deformation of these markers is captured by the camera. I investigated how dense the marker array needed to be by adjusting the spacing between markers to determine what worked best for this application.

The third contribution involved sensor fusion to improve reliability and robustness. To do this, I integrated a gyroscope and used Kalman filtering to fuse data from the gyroscope and the MCP. This was important for Gamma Knife systems, which are radiosurgery platforms used for brain cancers. They tend to have higher accuracy requirements than linear accelerators, which are commonly used for head and neck cancers, and lower constraints on the use of ferromagnetic components.

The final contribution was a participatory design study conducted in collaboration with clinicians and the social sciences department. We explored how the MCP could be integrated into hospital workflows and assessed its feasibility.

How feasible is it to integrate this sensor into hospital workflows?

Clinicians did seem to be very on board with it, but the study was more qualitative than quantitative. While they felt the idea had merit, there were reservations about adopting new technology and the associated learning curve.

They were also concerned about accuracy. Improving accuracy and reliability is essential for clinicians to feel confident using the system. At present, further development is needed before it can be widely implemented.

What future work is planned in this area?

One area to investigate is the differences between the mannequin and participant data. The pillow shape is controlled by a pneumatic system with a pressure sensor and air pump. When the patient or mannequin moves, pressure changes occur. The system compensates to maintain a set pressure, but this introduces errors in the motion readings. The mannequin produced more errors than the participant data. It may not accurately simulate human motion on the pillow, and the testing setup may introduce discrepancies that do not reflect real-world behaviour.

So, future work includes stabilising and refining the pressure control system to improve reliability. If necessary, reconsidering the use of gel on the sensors could be an option. Gel had been used previously but was abandoned due to clinician concerns about attenuation of ionising beams. However, if avoiding gel significantly compromises sensor performance, revisiting this approach may be worthwhile.

In addition, more participant data collection is needed. Not all previously collected data could be used due to ground-truth measurements being partially occluded in the experimental setup. Additional participant studies would provide a clearer understanding of performance across different individuals. Another priority is improving the fibrescope’s resolution and angle to better visualise high-density marker arrays. Hardware upgrades would help ensure a clearer field of view and improve overall system performance.

About Bhoomika

|

Bhoomika Gandhi is a recent PhD graduate from the University of Sheffield Medical Robotics group. Her undergraduate degree was in Bioengineering – Medical Devices and Instruments, with control engineering and robotics being the key themes. |