Are the New GPT-OSS Models Any Good? We put them to the test.

OpenAI hasn’t released an open-weight language model since GPT-2 back in 2019. Six years later, they surprised everyone with two: gpt-oss-120b and the smaller gpt-oss-20b.

Naturally, we wanted to know — how do they actually perform?

To find out, we ran both models through our open-source workflow optimization framework, syftr. It evaluates models across different configurations — fast vs. cheap, high vs. low accuracy — and includes support for OpenAI’s new “thinking effort” setting.

In theory, more thinking should mean better answers. In practice? Not always.

We also use syftr to explore questions like “is LLM-as-a-Judge actually working?” and “what workflows perform well across many datasets?”.

Our first results with GPT-OSS might surprise you: the best performer wasn’t the biggest model or the deepest thinker.

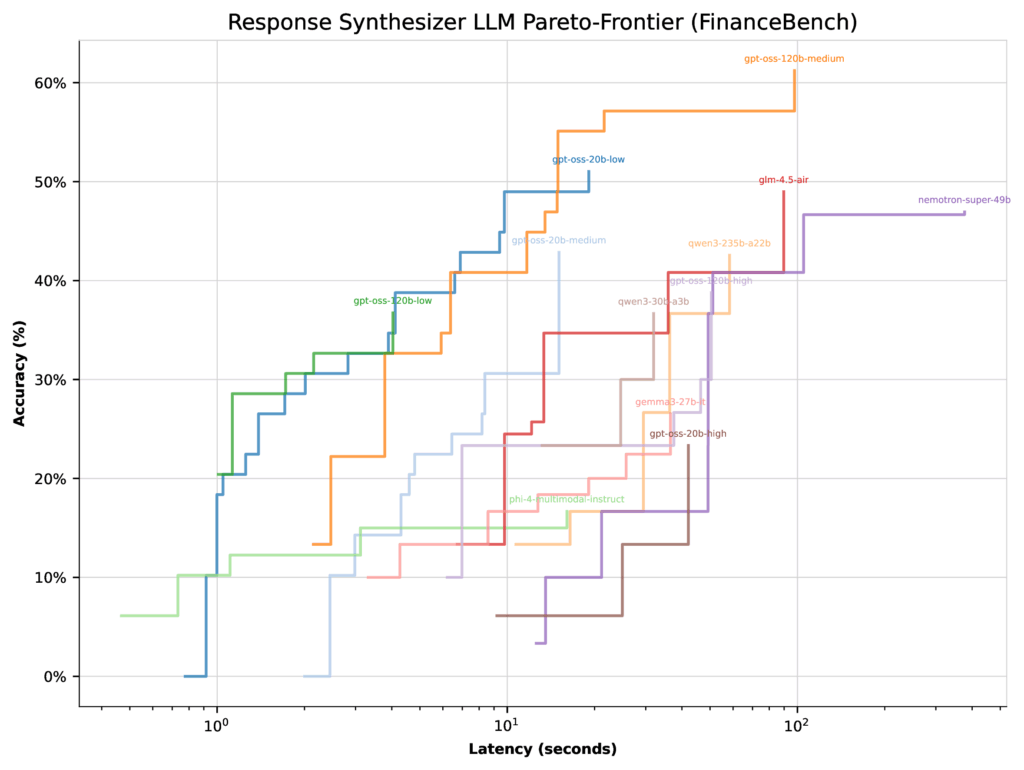

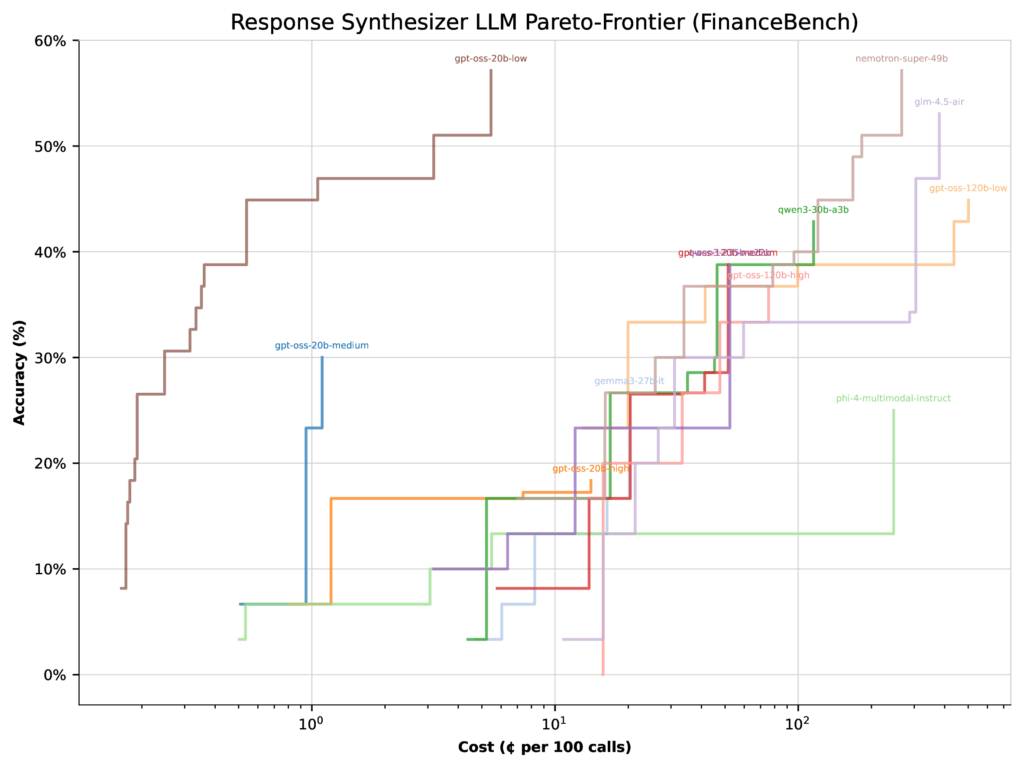

Instead, the 20b model with low thinking effort consistently landed on the Pareto frontier, even rivaling the 120b medium configuration on benchmarks like FinanceBench, HotpotQA, and MultihopRAG. Meanwhile, high thinking effort rarely mattered at all.

How we set up our experiments

We didn’t just pit GPT-OSS against itself. Instead, we wanted to see how it stacked up against other strong open-weight models. So we compared gpt-oss-20b and gpt-oss-120b with:

- qwen3-235b-a22b

- glm-4.5-air

- nemotron-super-49b

- qwen3-30b-a3b

- gemma3-27b-it

- phi-4-multimodal-instruct

To test OpenAI’s new “thinking effort” feature, we ran each GPT-OSS model in three modes: low, medium, and high thinking effort. That gave us six configurations in total:

- gpt-oss-120b-low / -medium / -high

- gpt-oss-20b-low / -medium / -high

For evaluation, we cast a wide net: five RAG and agent modes, 16 embedding models, and a range of flow configuration options. To judge model responses, we used GPT-4o-mini and compared answers against known ground truth.

Finally, we tested across four datasets:

- FinanceBench (financial reasoning)

- HotpotQA (multi-hop QA)

- MultihopRAG (retrieval-augmented reasoning)

- PhantomWiki (synthetic Q&A pairs)

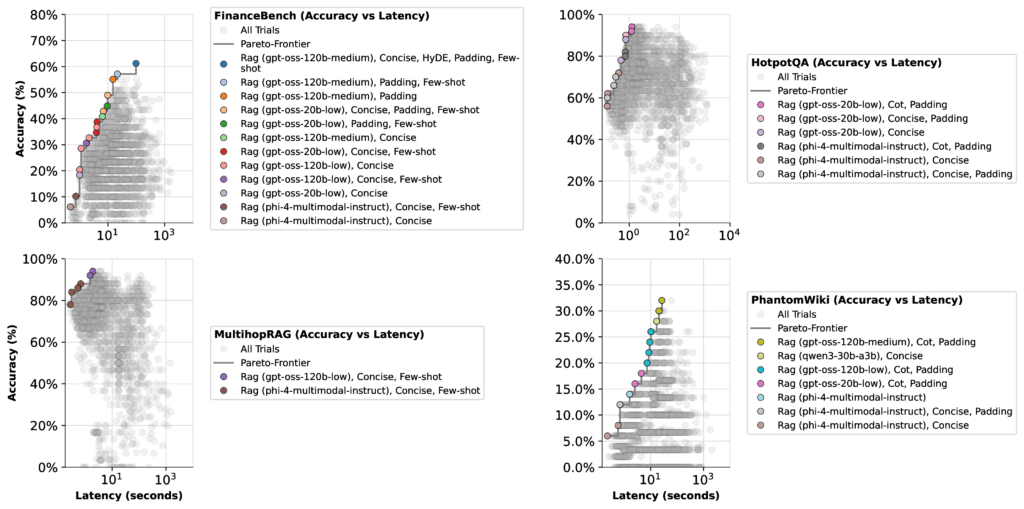

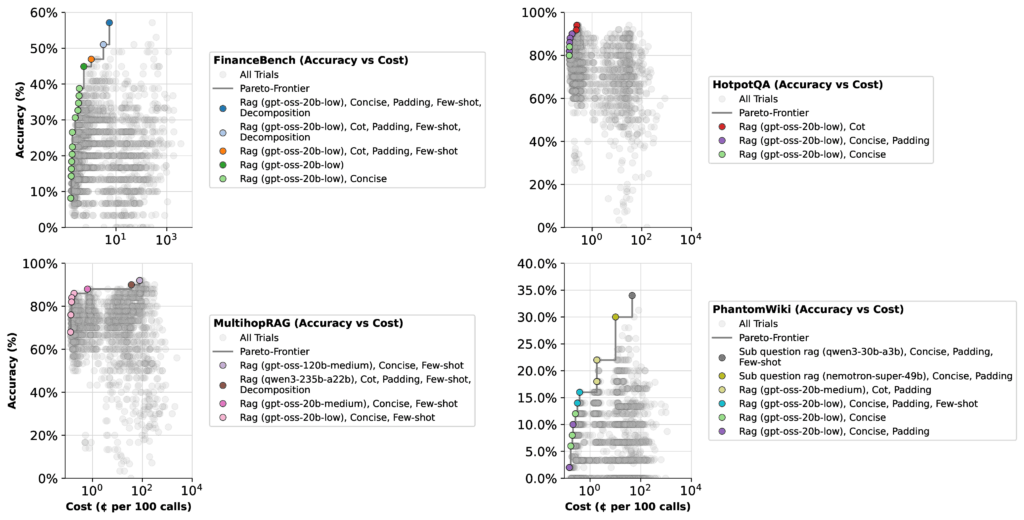

We optimized workflows twice: once for accuracy + latency, and once for accuracy + cost—capturing the tradeoffs that matter most in real-world deployments.

Optimizing for latency, cost, and accuracy

When we optimized the GPT-OSS models, we looked at two tradeoffs: accuracy vs. latency and accuracy vs. cost. The results were more surprising than we expected:

- GPT-OSS 20b (low thinking effort):

Fast, inexpensive, and consistently accurate. This setup appeared on the Pareto frontier repeatedly, making it the best default choice for most non-scientific tasks. In practice, that means quicker responses and lower bills compared to higher thinking efforts. - GPT-OSS 120b (medium thinking effort):

Best suited for tasks that demand deeper reasoning, like financial benchmarks. Use this when accuracy on complex problems matters more than cost. - GPT-OSS 120b (high thinking effort):

Expensive and usually unnecessary. Keep it in your back pocket for edge cases where other models fall short. For our benchmarks, it didn’t add value.

Reading the results more carefully

At first glance, the results look straightforward. But there’s an important nuance: an LLM’s top accuracy score depends not just on the model itself, but on how the optimizer weighs it against other models in the mix. To illustrate, let’s look at FinanceBench.

When optimizing for latency, all GPT-OSS models (except high thinking effort) landed with similar Pareto-frontiers. In this case, the optimizer had little reason to concentrate on the 20b low thinking configuration—its top accuracy was only 51%.

When optimizing for cost, the picture shifts dramatically. The same 20b low thinking configuration jumps to 57% accuracy, while the 120b medium configuration actually drops 22%. Why? Because the 20b model is far cheaper, so the optimizer shifts more weight toward it.

The takeaway: Performance depends on context. Optimizers will favor different models depending on whether you’re prioritizing speed, cost, or accuracy. And given the huge search space of possible configurations, there may be even better setups beyond the ones we tested.

Finding agentic workflows that work well in your setup

The new GPT-OSS models performed strongly in our tests — especially the 20b with low thinking effort, which often outpaced more expensive competitors. The bigger lesson? More model and more effort doesn’t always mean more accuracy. Sometimes, paying more just gets you less.

This is exactly why we built syftr and made it open-source. Every use case is different, and the best workflow for you depends on the tradeoffs you care about most. Want lower costs? Faster responses? Maximum accuracy?

Run your own experiments and find the Pareto sweet spot that balances those priorities for your setup.

The post Are the New GPT-OSS Models Any Good? We put them to the test. appeared first on DataRobot.

Biohybrid crawlers can be controlled using optogenetic techniques

Simulated humanoid robots learn to hike rugged terrain autonomously

Matryoshka doll-like robot changes its shape in real time and in situ

Social robots can help relieve the pressures felt by caregivers

A security robot failed in NYC: Now, it’s trying to protect downtown Kansas City

Sensing the Shift: Trends in Smart Industrial Automation

#ICML2025 outstanding position paper: Interview with Jaeho Kim on addressing the problems with conference reviewing

At this year’s International Conference on Machine Learning (ICML2025), Jaeho Kim, Yunseok Lee and Seulki Lee won an outstanding position paper award for their work Position: The AI Conference Peer Review Crisis Demands Author Feedback and Reviewer Rewards. We hear from Jaeho about the problems they were trying to address, and their proposed author feedback mechanism and reviewer reward system.

Could you say something about the problem that you address in your position paper?

Our position paper addresses the problems plaguing current AI conference peer review systems, while also raising questions about the future direction of peer review.

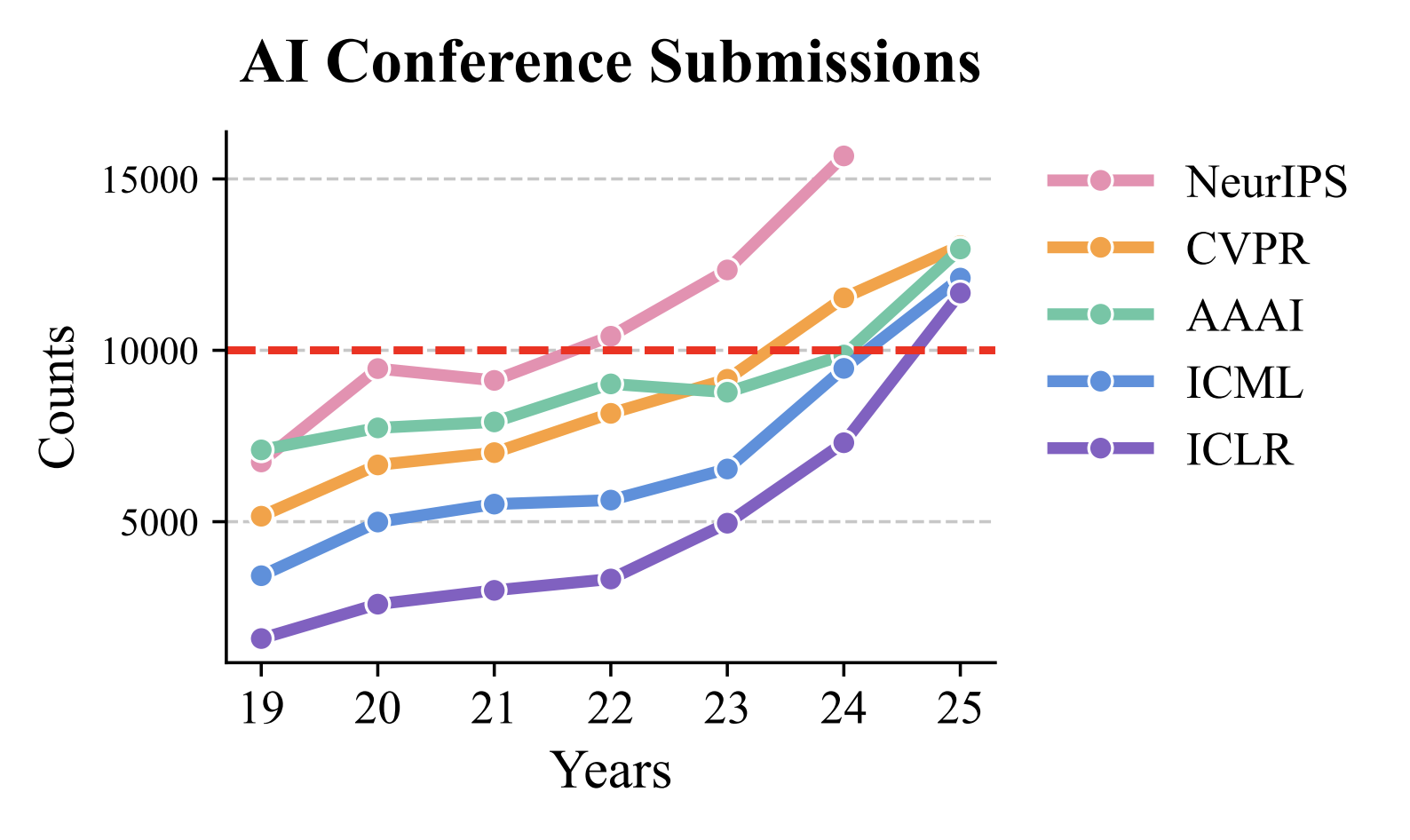

The imminent problem with the current peer review system in AI conferences is the exponential growth in paper submissions driven by increasing interest in AI. To put this with numbers, NeurIPS received over 30,000 submissions this year, while ICLR saw a 59.8% increase in submissions in just one year. This huge increase in submissions has created a fundamental mismatch: while paper submissions grow exponentially, the pool of qualified reviewers has not kept pace.

Submissions to some of the major AI conferences over the past few years.

Submissions to some of the major AI conferences over the past few years.

This imbalance has severe consequences. The majority of papers are no longer receiving adequate review quality, undermining peer review’s essential function as a gatekeeper of scientific knowledge. When the review process fails, inappropriate papers and flawed research can slip through, potentially polluting the scientific record.

Considering AI’s profound societal impact, this breakdown in quality control poses risks that extend far beyond academia. Poor research that enters the scientific discourse can mislead future work, influence policy decisions, and ultimately hinder genuine knowledge advancement. Our position paper focuses on this critical question and proposes methods on how we can enhance the quality of review, thus leading to better dissemination of knowledge.

What do you argue for in the position paper?

Our position paper proposes two major changes to tackle the current peer review crisis: an author feedback mechanism and a reviewer reward system.

First, the author feedback system enables authors to formally evaluate the quality of reviews they receive. This system allows authors to assess reviewers’ comprehension of their work, identify potential signs of LLM-generated content, and establish basic safeguards against unfair, biased, or superficial reviews. Importantly, this isn’t about penalizing reviewers, but rather creating minimal accountability to protect authors from the small minority of reviewers who may not meet professional standards.

Second, our reviewer incentive system provides both immediate and long-term professional value for quality reviewing. For short-term motivation, author evaluation scores determine eligibility for digital badges (such as “Top 10% Reviewer” recognition) that can be displayed on academic profiles like OpenReview and Google Scholar. For long-term career impact, we propose novel metrics like a “reviewer impact score” – essentially an h-index calculated from the subsequent citations of papers a reviewer has evaluated. This treats reviewers as contributors to the papers they help improve and validates their role in advancing scientific knowledge.

Could you tell us more about your proposal for this new two-way peer review method?

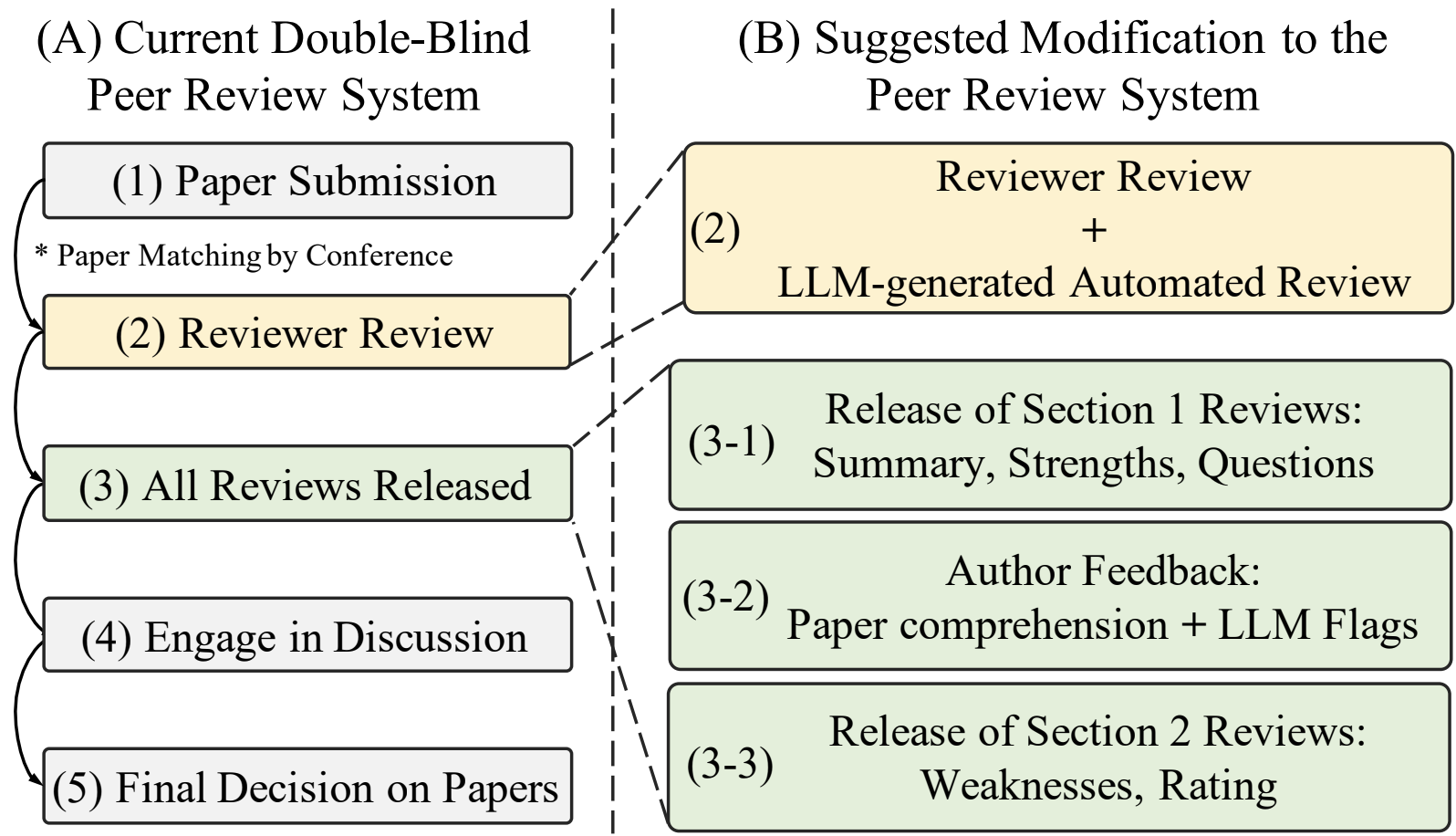

Our proposed two-way peer review system makes one key change to the current process: we split review release into two phases.

The authors’ proposed modification to the peer-review system.

The authors’ proposed modification to the peer-review system.

Currently, authors submit papers, reviewers write complete reviews, and all reviews are released at once. In our system, authors first receive only the neutral sections – the summary, strengths, and questions about their paper. Authors then provide feedback on whether reviewers properly understood their work. Only after this feedback do we release the second part containing weaknesses and ratings.

This approach offers three main benefits. First, it’s practical – we don’t need to change existing timelines or review templates. The second phase can be released immediately after the authors give feedback. Second, it protects authors from irresponsible reviews since reviewers know their work will be evaluated. Third, since reviewers typically review multiple papers, we can track their feedback scores to help area chairs identify (ir)responsible reviewers.

The key insight is that authors know their own work best and can quickly spot when a reviewer hasn’t properly engaged with their paper.

Could you talk about the concrete reward system that you suggest in the paper?

We propose both short-term and long-term rewards to address reviewer motivation, which naturally declines over time despite starting enthusiastically.

Short-term: Digital badges displayed on reviewers’ academic profiles, awarded based on author feedback scores. The goal is making reviewer contributions more visible. While some conferences list top reviewers on their websites, these lists are hard to find. Our badges would be prominently displayed on profiles and could even be printed on conference name tags.

Example of a badge that could appear on profiles.

Example of a badge that could appear on profiles.

Long-term: Numerical metrics to quantify reviewer impact at AI conferences. We suggest tracking measures like an h-index for reviewed papers. These metrics could be included in academic portfolios, similar to how we currently track publication impact.

The core idea is creating tangible career benefits for reviewers while establishing peer review as a professional academic service that rewards both authors and reviewers.

What do you think could be some of the pros and cons of implementing this system?

The benefits of our system are threefold. First, it is a very practical solution. Our approach doesn’t change current review schedules or review burdens, making it easy to incorporate into existing systems. Second, it encourages reviewers to act more responsibly, knowing their work will be evaluated. We emphasize that most reviewers already act professionally – however, even a small number of irresponsible reviewers can seriously damage the peer review system. Third, with sufficient scale, author feedback scores will make conferences more sustainable. Area chairs will have better information about reviewer quality, enabling them to make more informed decisions about paper acceptance.

However, there is strong potential for gaming by reviewers. Reviewers might optimize for rewards by giving overly positive reviews. Measures to counteract these problems are definitely needed. We are currently exploring solutions to address this issue.

Are there any concluding thoughts you’d like to add about the potential future

of conferences and peer-review?

One emerging trend we’ve observed is the increasing discussion of LLMs in peer review. While we believe current LLMs have several weaknesses (e.g., prompt injection, shallow reviews), we also think they will eventually surpass humans. When that happens, we will face a fundamental dilemma: if LLMs provide better reviews, why should humans be reviewing? Just as the rapid rise of LLMs caught us unprepared and created chaos, we cannot afford a repeat. We should start preparing for this question as soon as possible.

About Jaeho

|

Jaeho Kim is a Postdoctoral Researcher at Korea University with Professor Changhee Lee. He received his Ph.D. from UNIST under the supervision of Professor Seulki Lee. His main research focuses on time series learning, particularly developing foundation models that generate synthetic and human-guided time series data to reduce computational and data costs. He also contributes to improving the peer review process at major AI conferences, with his work recognized by the ICML 2025 Outstanding Position Paper Award. |

Read the work in full

Position: The AI Conference Peer Review Crisis Demands Author Feedback and Reviewer Rewards, Jaeho Kim, Yunseok Lee, Seulki Lee.

The MOTIF Hand: A tool advancing the capabilities of previous robot hand technology

ChatGPT Competitor Amps-Up Performance

Users on higher tier plans can now use the Claude chatbot to do intensive research on the Web, bring back raw data and then transform what it finds into written insights, statistical analysis and charts.

Currently, access to the new feature is available to Claude Max users and Claude Team users – with access for Claude Pro users promised soon, according to writer Emila David.

Meanwhile, Claude has also been outfitted with a new memory feature for its Team and Enterprise users, which enables the app to remember projects, preferences and priorities.

In other news and analysis on AI writing:

*Major Survey App Gets AI Upgrade: SurveyMonkey – a key leader in automated surveying for years – has added a new suite of AI tools to its mix.

Users engaging in survey research with the tool can now:

–Use AI chat to surface instant insights and sophisticated data segmentation from the tool’s automated surveys

–Sift for themes in data brought back by SurveyMonkey using a new beta tool dubbed ‘Thematic Analysis.’

*AI Talking Heads Get Even More Lifelike: AI-generated, photorealistic talking heads – the kind that human news anchors up at night – are getting even more natural looking, accord to writer Rhiannon Williams.

Observes Williams, who tried out the latest generation of AI talking heads from Synthesia: “I found the video demonstrating my avatar as unnerving as it is technically impressive.

“It’s slick enough to pass as a high-definition recording of a chirpy corporate speech. And if you didn’t know me, you’d probably think that’s exactly what it was.

“This demonstration shows how much harder it’s becoming to distinguish the artificial from the real.”

*Skepticism Over the ‘Magic’ of AI Agents Persists: Despite blue-sky promises, AI agents – designed in a perfect world to handle tasks autonomously for you on the Web and elsewhere – are still getting a bad rap.

Observes writer Rory Bathgate: “Let’s be very clear here: AI agents are still not very good at their ‘jobs’, or at least pretty terrible at producing returns on investment.”

In fact, tech market research firm Gartner is predicting that 40% of agents currently used by business will be ‘put out to pasture’ by 2027.

*Top 20 Tools in AI Search Optimization (SEO): India-based business pub OfficeChai has come out with its list of the best AI tools right now for SEO.

Here are the top five:

–Surfer SEO

–Jasper

–Semrush

–MarketMuse

–Frase.io

*Embracing AI: A Leadership Guide: ChatGPT-maker OpenAI – which knows a thing or two about the tech – is out with a new guide for business leaders considering bringing in AI.

The easy-to-read 15-page guide offers tips on bringing management and staff onboard, ramping up and making the most of the tech.

The guide also features links to a number of key AI reports and case studies of successful AI implementations.

*OpenAI’s Speech-to-Text AI Gets Some Polish: Whisper – a speech-to-text transcriber from ChatGPT’s maker – just got more accurate.

Thanks to an upgrade from a group of outside researchers, the app is now much better transcribing speech as it happens in real-time.

Ever better, the tech is now able to deliver those transcriptions when run on everyday office computers.

*Microsoft Adds ChatGPT Competitor’s Tech to Office 365: In an interesting move, Microsoft is adding AI to some features of its Office 365 from ChatGPT rival Anthropic.

Specifically, Microsoft will be injecting Anthropic’s AI – which runs the Claude chatbot – into Office 365 apps like Excel, Powerpoint and Word.

Currently, Microsoft uses AI from a number of AI leaders to help run Office 365 and its in-house chatbot, Copilot.

*Oracle’s AI Play Stuns Investors: Half century old Oracle – a provider of database and cloud software – has suddenly emerged as a key player in AI.

The company – which helps companies like ChatGPT’s maker run their AI – announced last week that many of those AI contracts should swell its cloud revenue to $114 billion by 2029.

The result: Oracle’s stock, already up 45% for 2025, surged another 40% in just one day last week, according to writer Dan Gallagher.

*AI Big Picture: Arab Nation UAE Joins AI Open Source Movement: United Arab Emirates has released open source AI – or AI available for anyone to use for free – it says competes with the latest AI from ChatGPT’s maker.

Observes writer Cade Metz: “The Emirates is among several nations pouring billions of dollars into computer data centers and research to compete with leading nations like the United States and China in artificial intelligence.

“Countries such as Saudi Arabia and Singapore are embracing the idea that the A.I. is so important, each should have its own version of the technology.”

Share a Link: Please consider sharing a link to https://RobotWritersAI.com from your blog, social media post, publication or emails. More links leading to RobotWritersAI.com helps everyone interested in AI-generated writing.

–Joe Dysart is editor of RobotWritersAI.com and a tech journalist with 20+ years experience. His work has appeared in 150+ publications, including The New York Times and the Financial Times of London.

The post ChatGPT Competitor Amps-Up Performance appeared first on Robot Writers AI.