Ethics is the new Quality

I took part in the first panel at the BSI conference The Digital World: Artificial Intelligence. The subject of the panel was AI Governance and Ethics. My co-panelist was Emma Carmel, and we were expertly chaired by Katherine Holden.

Emma and I each gave short opening presentations prior to the Q&A. The title of my talk was Why is Ethical Governance in AI so hard? Something I’ve thought about alot in recent months.

Here are the slides exploring that question.

And here are my words.

Early in 2018 I wrote a short blog post with the title Ethical Governance: what is it and who’s doing it? Good ethical governance is important because in order for people to have confidence in their AI they need to know that it has been developed responsibly. I concluded my piece by asking for examples of good ethical governance. I had several replies, but none were nominating AI companies.

So. why is it that 3 years on we see some of the largest AI companies on the planet shooting themselves in the foot, ethically speaking? I’m not at all sure I can offer an answer but, in the next few minutes, I would like to explore the question: why is ethical governance in AI so hard?

But from a new perspective.

Slide 2

In the early 1970s I spent a few months labouring in a machine shop. The shop was chaotic and disorganised. It stank of machine oil and cigarette smoke, and the air was heavy with the coolant spray used to keep the lathe bits cool. It was dirty and dangerous, with piles of metal swarf cluttering the walkways. There seemed to be a minor injury every day.

Skip forward 40 years and machine shops look very different.

Slide 3

So what happened? Those of you old enough will recall that while British design was world class – think of the British Leyland Mini, or the Jaguar XJ6 – our manufacturing fell far short. “By the mid 1970s British cars were shunned in Europe because of bad workmanship, unreliability, poor delivery dates and difficulties with spares. Japanese car manufacturers had been selling cars here since the mid 60s but it was in the 1970s that they began to make real headway. Japanese cars lacked the style and heritage of the average British car. What they did have was superb build quality and reliability”*.

What happened was Total Quality Management. The order and cleanliness of modern machine shops like this one is a strong reflection of TQM practices.

Slide 4

In the late 1970s manufacturing companies in the UK learned – many the hard way – that ‘quality’ is not something that can be introduced by appointing a quality inspector. Quality is not something that can be hired in.

This word cloud reflects the influence from Japan. The words Japan, Japanese and Kaizen – which roughly translates as continuous improvement – appear here. In TQM everyone shares the responsibility for quality. People at all levels of an organization participate in kaizen, from the CEO to assembly line workers and janitorial staff. Importantly suggestions from anyone, no matter who, are valued and taken equally seriously.

Slide 5

In 2018 my colleague Marina Jirotka and I published a paper on ethical governance in robotics and AI. In that paper we proposed 5 pillars of good ethical governance. The top four are:

- have an ethical code of conduct,

- train everyone on ethics and responsible innovation,

- practice responsible innovation, and

- publish transparency reports.

The 5th pillar underpins these four and is perhaps the hardest: really believe in ethics.

Now a couple of months ago I looked again at these 5 pillars and realised that they parallel good practice in Total Quality Management: something I became very familiar with when I founded and ran a company in the mid 1980s.

Slide 6

So, if we replace ethics with quality management, we see a set of key processes which exactly parallel our 5 pillars of good ethical governance, including the underpinning pillar: believe in total quality management.

I believe that good ethical governance needs the kind of corporate paradigm shift that was forced on UK manufacturing industry in the 1970s.

Slide 7

In a nutshell I think ethics is the new quality

Yes, setting up an ethics board or appointing an AI ethics officer can help, but on their own these are not enough. Like Quality, everyone needs to understand and contribute to ethics. Those contributions should be encouraged, valued and acted upon. Nobody should be fired for calling out unethical practices.

Until corporate AI understands this we will, I think, struggle to find companies that practice good ethical governance.

Quality cannot be ‘inspected in’, and nor can ethics.

Thank you.

Notes.

[1] I’m quoting here from the excellent history of British Leyland by Ian Nicholls.

[2] My company did a huge amount of work for Motorola and – as a subcontractor – we became certified software suppliers within their six sigma quality management programme.

[3] It was competitive pressure that forced manufacturing companies in the 1970s to up their game by embracing TQM. Depressingly the biggest AI companies face no such competitive pressures, which is why regulation is both necessary and inevitable.

A helping hand for working robots

Seafood Processors Turning to Robotics And Automation

Researchers create robot that smiles back

#333: Snake-like Robot as a Worker Companion, with Matt Bilsky

Matt Bilsky, founder and CEO of FLX Solutions, discusses the snake-like robot he invented called the FLX BOT. The FLX BOT consists of modular links, each with a joint that can extend and rotate to get into tight spaces. Each link includes sensors including inertial measurement units and a camera. The robot is used to navigate and work in challenging environments, such as above ceilings and within walls. Matt discusses the key innovations of his product as well as his academic and entrepreneurial journey that led him to the FLX BOT.

Matt Bilksy

Matt Bilsky, PhD, PE is the inventor of the FLX BOT, a licensed Professional Engineer, a Mechanical Engineering professor at Lehigh University, and a former repair/maintenance contractor. In 2017, he was awarded with the Lehigh University Entrepreneurship Educator of the Year. Matt has a Mechanical Engineering Ph.D. from Lehigh University focused on smart product design, Technical Entrepreneurship, and mechatronics. He holds two additional Lehigh degrees: a BS in Mechanical Engineering with an Electrical Engineering minor and a Master of Engineering degree also in Mechanical Engineering. Since he was a child Matt has been an innovator. In his basement shop he designed and built numerous electronic gadgets. In 2003 he started his first company, Mattcomp Services LLC, offering computer repair, networking, home theater, and handyman services. He also created a web hosting company in 2005, Mattcomp Hosting, including all necessary back-end components on dedicated servers.

Links

Slender robotic finger senses buried items

By Daniel Ackerman

Over the years, robots have gotten quite good at identifying objects — as long as they’re out in the open.

Discerning buried items in granular material like sand is a taller order. To do that, a robot would need fingers that were slender enough to penetrate the sand, mobile enough to wriggle free when sand grains jam, and sensitive enough to feel the detailed shape of the buried object.

MIT researchers have now designed a sharp-tipped robot finger equipped with tactile sensing to meet the challenge of identifying buried objects. In experiments, the aptly named Digger Finger was able to dig through granular media such as sand and rice, and it correctly sensed the shapes of submerged items it encountered. The researchers say the robot might one day perform various subterranean duties, such as finding buried cables or disarming buried bombs.

The research will be presented at the next International Symposium on Experimental Robotics. The study’s lead author is Radhen Patel, a postdoc in MIT’s Computer Science and Artificial Intelligence Laboratory (CSAIL). Co-authors include CSAIL PhD student Branden Romero, Harvard University PhD student Nancy Ouyang, and Edward Adelson, the John and Dorothy Wilson Professor of Vision Science in CSAIL and the Department of Brain and Cognitive Sciences.

Seeking to identify objects buried in granular material — sand, gravel, and other types of loosely packed particles — isn’t a brand new quest. Previously, researchers have used technologies that sense the subterranean from above, such as Ground Penetrating Radar or ultrasonic vibrations. But these techniques provide only a hazy view of submerged objects. They might struggle to differentiate rock from bone, for example.

“So, the idea is to make a finger that has a good sense of touch and can distinguish between the various things it’s feeling,” says Adelson. “That would be helpful if you’re trying to find and disable buried bombs, for example.” Making that idea a reality meant clearing a number of hurdles.

The team’s first challenge was a matter of form: The robotic finger had to be slender and sharp-tipped.

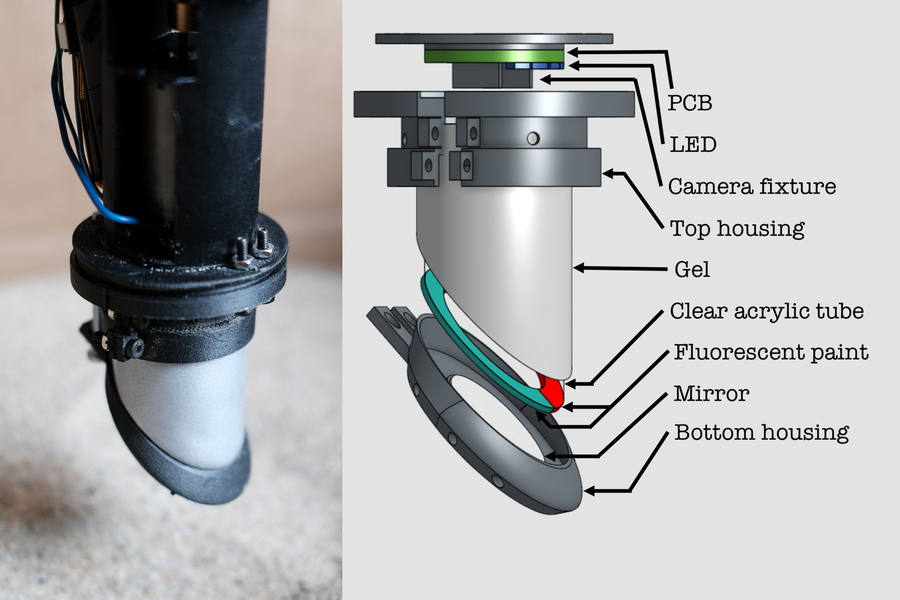

In prior work, the researchers had used a tactile sensor called GelSight. The sensor consisted of a clear gel covered with a reflective membrane that deformed when objects pressed against it. Behind the membrane were three colors of LED lights and a camera. The lights shone through the gel and onto the membrane, while the camera collected the membrane’s pattern of reflection. Computer vision algorithms then extracted the 3D shape of the contact area where the soft finger touched the object. The contraption provided an excellent sense of artificial touch, but it was inconveniently bulky.

For the Digger Finger, the researchers slimmed down their GelSight sensor in two main ways. First, they changed the shape to be a slender cylinder with a beveled tip. Next, they ditched two-thirds of the LED lights, using a combination of blue LEDs and colored fluorescent paint. “That saved a lot of complexity and space,” says Ouyang. “That’s how we were able to get it into such a compact form.” The final product featured a device whose tactile sensing membrane was about 2 square centimeters, similar to the tip of a finger.

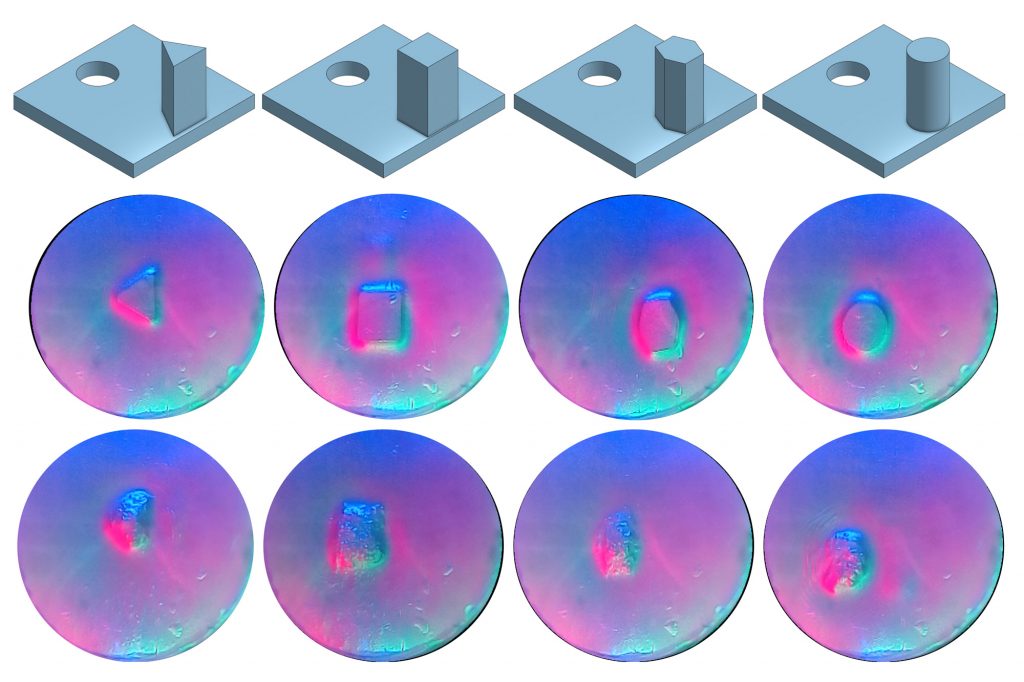

With size sorted out, the researchers turned their attention to motion, mounting the finger on a robot arm and digging through fine-grained sand and coarse-grained rice. Granular media have a tendency to jam when numerous particles become locked in place. That makes it difficult to penetrate. So, the team added vibration to the Digger Finger’s capabilities and put it through a battery of tests.

“We wanted to see how mechanical vibrations aid in digging deeper and getting through jams,” says Patel. “We ran the vibrating motor at different operating voltages, which changes the amplitude and frequency of the vibrations.” They found that rapid vibrations helped “fluidize” the media, clearing jams and allowing for deeper burrowing — though this fluidizing effect was harder to achieve in sand than in rice.

They also tested various twisting motions in both the rice and sand. Sometimes, grains of each type of media would get stuck between the Digger-Finger’s tactile membrane and the buried object it was trying to sense. When this happened with rice, the trapped grains were large enough to completely obscure the shape of the object, though the occlusion could usually be cleared with a little robotic wiggling. Trapped sand was harder to clear, though the grains’ small size meant the Digger Finger could still sense the general contours of target object.

Patel says that operators will have to adjust the Digger Finger’s motion pattern for different settings “depending on the type of media and on the size and shape of the grains.” The team plans to keep exploring new motions to optimize the Digger Finger’s ability to navigate various media.

Adelson says the Digger Finger is part of a program extending the domains in which robotic touch can be used. Humans use their fingers amidst complex environments, whether fishing for a key in a pants pocket or feeling for a tumor during surgery. “As we get better at artificial touch, we want to be able to use it in situations when you’re surrounded by all kinds of distracting information,” says Adelson. “We want to be able to distinguish between the stuff that’s important and the stuff that’s not.”

Funding for this research was provided, in part, by the Toyota Research Institute through the Toyota-CSAIL Joint Research Center; the Office of Naval Research; and the Norwegian Research Council.

Why is Robotics-as-a-Service So Important Now

Regularization techniques for training deep neural networks

Slender robotic finger senses buried items

How Robotics is Transforming Manufacturing

Making “cheddar” With Industrial Automation – Achieving 83 Per Cent Waste Reduction in Food Manufacturing

The MIT humanoid robot: A dynamic robotic that can perform acrobatic behaviors

Robots at the ready – The future of warehouse automation

Meet the #NCCRWomen in robotics

Meet Maria Vittoria and Inés!

To celebrate Women’s Day 2021 and the 50th anniversary of women’s right to vote in Switzerland, the Swiss NCCRs (National Centres of Competence in Research) wanted to show you who our women researchers are and what a day in their job looks like. The videos are targeted at women and girls of school and undergraduate age to show what day to day life as a scientist is like and make it more accessible. Each NCCR hosted a week where they published several videos covering multiple scientific disciplines, and here we are bringing you what was produced by NCCR Digital Fabrication.

The videos cover a wide range of subjects, including (but not limited to) maths, physics, microbiology, psychology and planetary science, but here we have two women who work with robots.

Maria Vittoria Minniti is a robotics engineer and PhD student, she enhances mobile manipulation capabilities in under-actuated robots.

Inés Ariza is an architect, she uses a robot to 3D print custom metal joints for complex structures.

Head over to YouTube or Instagram (English, German or French) to see the women featured in the #NCCRWomen campaign.